Digital Banking Applications: Cross-cultural Design Considerations in Asia

In Asia, there is a large and growing proportion of consumers getting on board the digital banking applications train.

By James Breeze, ACI Fellow & Founder, Objective Experience

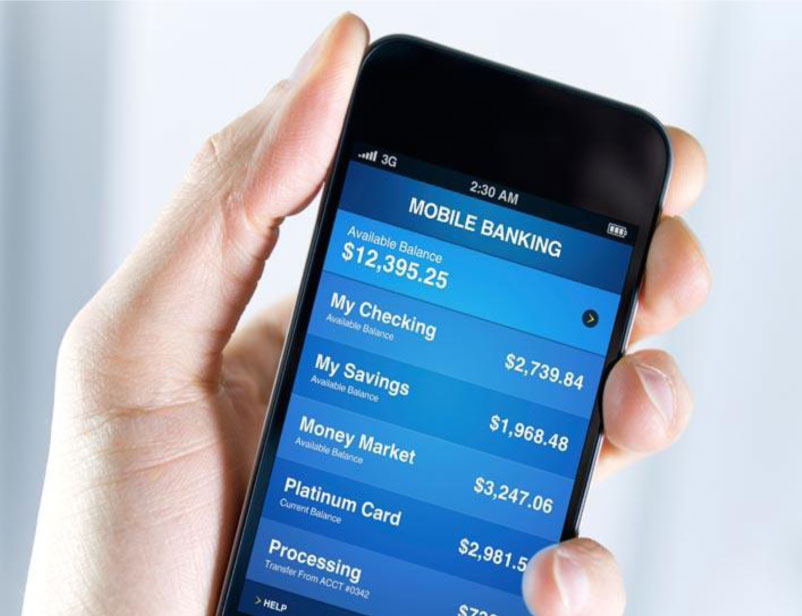

In Asia, there is a large and growing proportion of consumers getting on board the digital banking applications train. Most of the major banks are developing web and mobile applications so that their consumers can gain easy access to their banking accounts, transactions and other financial information. Consumer adoption of such apps is rising in Asia thanks to the rapidly improving technological infrastructure. To date, 33% of Singapore's entire population engages in mobile banking, 29% in Hong Kong and 9% in India.

There is also a growing emphasis on localising apps that can accommodate individual cultural preferences and norms to keep consumers happy, yet still retain universal functions and interactions that can be used across international consumer segments.

In either case, the design of the online or mobile banking app interaction and interface has to take into account what consumers are intuitively able to do. The easier it is to use the app, combined with how useful it is to the consumer, the greater will be their liking and satisfaction levels. Indeed, there have been numerous cases where people have mishandled their monetary transactions because they did not understand how to use certain features on a banking app properly. Others have even switched banks because the user experience of the app essentially failed and caused major frustration.

And it is not just the design of the interface that matters, the design of the overall service experience during app use is also highly relevant - from persuading consumers to adopt such technologies in the first place, to ensuring their subsequent pleasure levels from financial transactions done well. All of these factors are fundamental in building good relationships between consumers and banks.

To better understand the most important facets of the mobile banking experience from the customer's perspective, a series of in-depth interviews and eye tracking tests were conducted by the team at Objective Experience Singapore (OESG). These studies revealed interesting similarities and differences in terms of expectations and experiences between consumers in different countries to the same online or mobile banking app. Below are some aspects elicited from these studies to be mindful of when designing the interaction of banking apps for Asian countries.

Trust

People rely on visual cues to determine how risky it is to use the app. If your consumers look at your banking app and find it visually lacking, there is a much higher tendency for them to feel that your app is neither safe nor trustworthy. This is especially the case with apps designed to manage financial transactions where an even higher level of trust has to be earned.

However, cross-cultural nuances amongst consumers from different Asian countries also have to be taken into consideration. Take, for example, this case study in which the same online banking app for stock trading was tested amongst consumers in Singapore and Hong Kong.

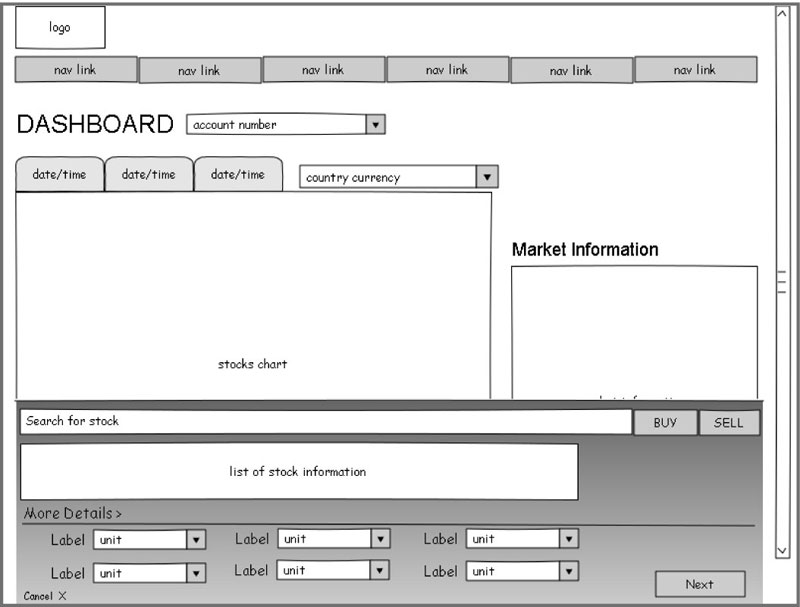

Figure 1. Wireframe of the online banking app's dashboard with the expanded sticky footer bar when a user enters information to search for stocks.

In this case, the sticky footer bar that permits customers to search for any individual stock was a feature that was positively accepted by consumers in Singapore but not in Hong Kong. Singaporeans it turns out appear to have much more of an early adopter mindset. They try out newer technologies more quickly and have a higher risk threshold when it comes to privacy and security issues. In contrast, consumers in Hong Kong are considerably more security-detailed. For them, the sticky footer bar felt more like a click-out advertisement banner than a helpful search aid and the majority of consumers simply ignored the feature, perceiving it as not sufficiently trustworthy enough to be used.

Service

Consumers' service expectations were also found to differ from country to country across Asia. This has implications for the adoption rate and on-boarding/sign-up process.

In India, people expect a very high-level and personal approach to service. For example, it is entirely normal for customer service banking agents to bring banking documents and services directly into their customers' home, especially for people living in rural areas.

One particular mobile banking app was tested by OESG to see if banking customers in India were willing to travel to the bank's branch to complete the sign-up verification process if they were given a monetary incentive.

What we found was that customers in India were of the strong opinion that for them to utilise online or mobile banking, they would still wish to have knowledgeable bank representatives come to their homes to verify the app, sign them up and teach them how to use it. The personal relationships they had built with the bank would also ensure their continued usage.

Language

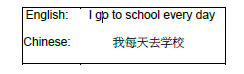

There are more than 2,000 spoken languages and dialects in Asia alone, with only some languages possessing a written form. However, with English fast becoming the primary language for communicating between countries, it is unsurprising that most banking apps are written in English. This may be acceptable in most Western countries, but in Asia other dominant languages have to be taken into account (e.g. Chinese). In addition, many banking apps are developed initially in English before being translated and adapted into the mother tongues of different countries. Such adaptations are, however, accompanied by a number of design issues.

If consumers are more comfortable reading and conducting their financial transactions in their dominant language, then banks should consider developing their apps in the country's dominant language instead.

As not all written languages are in alphabetical form, fonts become very important to comprehension of the app. This was apparent in one of OESG's studies of a mobile banking app for Hong Kong consumers, the majority of whom speak and write in Chinese. Written Chinese is logographic with little space in between the characters. The optimal font sizes, line spacing, kerning (spacing between individual letters) and tracking (spacing between blocks of text) parameters therefore have to be taken into consideration so that consumers are able to read Chinese smoothly without too much strain on their eyes (for more information and recommendation of the ideal Chinese font, please refer to Chan & Lee 2005 and Huang, Rau & Liu 2009).

Figure 2. An English sentence contains more characters and is longer than the Chinese sentence with the same meaning.

Figure 2. An English sentence contains more characters and is longer than the Chinese sentence with the same meaning.

Experience

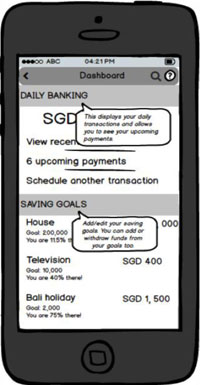

People prefer instantaneous actions and results when they are more experienced with what they are using. This was found to be similar across countries. Experience can be defined in two ways here. Firstly, people complete their intended tasks faster when they are familiar with other similar interactions on the more popular apps they have been previously using for the same purpose. The other type of experience that affects consumers' usage of digital banking apps is their banking experience itself. Those with little knowledge or experience with financial products and services tend to spend more time searching for information to aid their decision-making before completing the task itself. Experienced consumers, on the other hand, prefer to start their intended task immediately after logging in instead of being taken through an on-screen tutorial first. In the case of a new digital application, a contextual tutorial is therefore likely to be more flexible, allowing consumers with differing levels of experience to decide when they want to learn how to use the app for themselves (see example in Figure 3).

Figure 3. Tooltips popups whenever the user encounters the feature for the first time. The option to not show the tips again can also be provided for the user to select.

Conclusion

This paper has described just some of the aspects that designers need to take into consideration when designing digital banking applications for Asian consumers. Using these four factors of trust, service, language and experience as guidelines throughout the design and development process will help in the overall achievement of an optimal digital banking application and related user experience.

In the Americas and Australia, banks have already taken it upon themselves to build consumer research labs to cater to the needs of their own consumers for their digital products and services. It is now timely for banks operating in Asia to focus upon their diverse consumers' needs and behaviours in order to develop valuable, useful and user-friendly financial applications that will be sustainable and successful in the long run.

About the author

James Breeze is an ACI Fellow and a Customer and User Experience Strategist, Eye Tracking Expert, Usability Consultant and Photographer. He founded and runs Objective Experience in Sydney and Singapore and Objective Eye Tracking works across SE Asia. James is also a professional speaker and regular guest lecturer at universities across Australia and SE Asia.

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)