Crude Business

A critique of Responsible Resource-Driven Development

By Franklin Obeng-Odoom

Introduction

Countries that are resource rich tend to be materially poor. For many African economies, therefore, analysts have been trying to explain this puzzle. Even so, doing business with crude, crude business, is widespread in Africa. Could Responsible Resource-Driven Development (RRD) be the answer to turn crude business around? If state irresponsibility is the problem, does state responsibility stir a chain of benign reactions? Data systematically collected from around Africa, including Cameroon, much of Central Africa, and elsewhere like Nigeria, West Africa, suggest that RRD is, indeed, widely portrayed as a panacea, but that does not, nor cannot, demonstrate the empirical potency of responsible resource-driven development. We can learn more about Africa in the world by framing its problems as a reflection of global rent theft for which radically different alternative political-economic policies can usefully be considered.

Oil Curse

Africa is rich in oil. The continent makes up 11% of the global oil production and possesses 8% of the world’s total oil reserves. As of 2007, Nigeria, Angola, Cameroon, Chad, Congo-Brazzaville, Equatorial Guinea, and Gabon were collectively producing an estimated 5120 million barrels of oil (bbl) per day. Also, new oil fields are being developed (Obeng-Odoom, 2014, p. 5). Take Uganda. More than 200000 barrels of oil per day are expected from its budding oil industry. These barrels of ‘black gold’ are estimated to fetch the country between US$15bn -20bn worth of investment at the development phase, 40 per cent of which will accrue to companies in Uganda (The Economist, 2022a, pp. 31-32). In Mozambique, there were 61 wells, 24 appraisals, and 12 production wells already in operation in the 2019-2021 period (Selemane, 2022, p. 83). Coal mines are also active, with one recently sold for US$270 million with the new operator seeking to mine 15 million tonnes in 2022 and 18 million tonnes in 2023 (Selemane, 2022, p. 83).

Entire cities are built around, or at least draw on, such resources. Port Harcourt in Nigeria is one such example, so is Sekondi-Takoradi in Ghana, Luanda in Angola, and Ras Gharib in Egypt. A focus on oil is, therefore, critical to understanding African urban economies. Whether oiling urban and national economies is transformative is an empirical question.

In 2021, Amit Jain issued ‘a warning for poor nations rich in natural resources’. ‘Developing countries’, he noted, ‘often do not profit from wealth lying under the ground’. Lack of information, poor expertise, corruption, price volatility, and unfavourable terms of transactions were all given as possible reasons for the Global South to be cautious about natural resource abundance and dependence (Jain, 2021). These patterns are so common that many write of a resource curse theory or ‘thesis’ (Auty, 1993), at least.

A recent major review (Alssadek and Benhin, 2023) of the empirical literature published in Resources Policy shows that there are four explanations. ‘First, Dutch disease theory, which refers to appreciation of the exchange rate due to resources booming, leading to a decline in the manufacturing sector’. A second is institutional ‘where the wealth from natural resources leads to poor institutional quality by increasing corruption, reducing the quality of rule of law, causing civil wars, and weakening democratic accountability’. A third explanation is ‘disregarding investment into human capital due to over-optimism about the wealth that might be received from the natural resources sector’. A fourth is ‘poor investment in financial development. This might be attributed to the Dutch disease, lower institutional quality, and limited investment into human capital’ (Alssadek and Benhin, 2023, p.18).

In a review of several empirical studies, Alssadek and Benhin (2023, pp. 3-4) examine some major works carried out in 2019, 2020, 2021, and 2022 on resource abundance and economic growth in Africa. In 2019, one of these studies – based on panel data and others from 1970 to 2014 - found that ‘total natural resources rent significantly decreased economic growth’ in ‘21 SSA countries rich in natural resources’. In another case, 1998-2016 panel data and others from 22 SSA countries endowed with natural resources were studied. The results were that ‘natural resource rents have a significant positive impact on economic growth’. But in 2020 when 1990-2013 panel data and others from 22 African countries were studied, it was found that resource intensity adversely affect economic growth’. In 2021, 1990-2017 panel data and others from 43 SSA countries were studied. ‘Natural resource rents, oil rents, and gas rents’, the study found, ‘significantly decreased GDP per capita growth’.

The review of Dutch disease effects by Alssadek and Benhin (2023, pp. 3-4) show that, in one 2014 case, using panel and other data from 1970-2010 in 6 African oil-exporting countries, ‘oil revenues have an adverse effect on the manufacturing sector’. Three years later a study of Algeria, using time series and other data from 1960-2013, found that ‘oil boom significantly reduced output of the manufacturing sector’. Alssadek and Benhin (2023) work also reviewed a 2014 study of 49 African countries using 1975-2005 panel and other data on natural resources and institutions. That study shows that ‘oil wealth harms democracy’ (Alssadek and Benhin, 2023, p.7). Likewise, a 2022 study of 39 SSA countries’ panel and other data for the 2005-2019 period showed that ‘all natural resource variables significantly weaken all institutional indicators’ (Alssadek and Benhin, 2023, p.8). In these studies, Alssadek and Benhin, consider studies of several resources.

But, as the oil sector is the largest – some 90% - of all these resources, Michael Ross has put the case for replacing the generic name – ‘resource curse’ - with the more precise, Oil Curse (see, Ross, 2012, p. 1). The countries afflicted by the oil curse are, indeed, so accursed because they produce oil and because this oil is imported by other countries. In turn, it has been suggested that, if, the US, for example, simply stopped buying oil from these countries, the problem can be addressed. That simplistic answer does not take into account the logic of the market. Oil is a fungible commodity. If one supplier is shut out others would be found. The solution, then, is to address the problem directly.

For Ross (2012, pp. 4-5, 7-8), the story starts in the 1970s when the state started to nationalise big oil companies. But this gave rise to the problem of scale, stability, and secrecy. As long as the global market was ready to pay a steady flow of oil revenue allowed the ruling dispensation to maintain political stability. Scale, according to Ross, buys or buries dissent. More money gives more leverage to oil states to be intolerant of dissent. As their source of money is oil revenues, not taxes, oil states also become undemocratic. Price instability creates fiscal problems, monetary problems, and all the other features combine to cause factor allocation problems (inflated local currency, shrinking of the manufacturing and agricultural sectors), and secrecy creates problems of inequity.

Other problems are incidental. Consider the extraction process. It creates environmental problems. In his contribution to the Global South Encounters of 28 March, Nnimmo-Bassey (2022), the eminent environmental activist and the strident Nigerian critic of extractivism, pointed out that the oil industry has created an ‘ecological bomb’. Oil lands are now desolate, no longer capable of use as farm or grazing land. Water bodies polluted by oil extractivism are not able to serve as the natural habitat for water plants or animals. Humans cannot use such water bodies either as the water is not potable. The Niger Delta has become the quintessential case of oil-based environmental disaster. As Nnimmo-Bassey points out, ‘with over 1,481 wells, 275 flow stations, over 7,000 kilometres length of oil/gas pipelines and over 120 gas flare furnaces, the Niger Delta is an ecological bomb and one of the most polluted places in the world. Nnimmo Bassey called on the people of the region to rise and demand ecological justice. While the Niger Delta is a fitting metaphor for ecocide, extractive activities in other countries including gold and oil in Ghana; gas in Mozambique; coal, gold, and other minerals in South Africa; crude oil in South Sudan, and in Angola all follow the same pattern. To cap these, the exploited and vulnerable communities in these countries are exposed to climate change impacts which bring in insecurity and lock in.

Others have emphasised more political problems. ‘But the most important political fact about oil – and the reason it leads to so much trouble in so many developing countries – is that the revenues it bestows on governments are unusually large, do not come from taxes, fluctuate unpredictably, and can be easily hidden’ (Ross, 2012, p.6). For Ross, it is not factual that oil economies grow more slowly, ‘but rather that it has been normal when it should have been faster than normal, given the enormous revenues these governments have collected. Two factors can help explain this. First, average growth - the failure of the oil states to generate more jobs for women – which would have lowered fertility rates and population growth, and boosted per capita income growth; and second, the inability of their governments to cope with the extraordinary changes created by revenue volatility’ (Ross, 2012, p. 13).

As Ross’ diagnosis relates to the size, source, stability, and secrecy of oil revenues and how badly national oil companies manage such revenues, he recommends strategies that address these matters. These stretch ‘from the simple (extracting it more slowly) to the exotic (using barter contracts, oil-denominated loans, and partial privatization)’ (Ross, 2012, p.13). Other levers to pull in order to help ‘turn their natural resource wealth from a curse to a blessing’ (Ross, 2012, p.4), according to Ross, is ‘how governments can reform the ways they spend these revenues’ (p. 14). ‘There is one remedy that can help everywhere: greater transparency in how governments collect, manage, and spend their oil revenues...Transparency reforms in the oil-importing countries – whose voracious demand for fossil fuels is at the root of the resource curse – could have a powerful effect as well’ (Ross, 2012, p. 14). Merely weaning themselves from the cursed countries is not the solution. What is required must be to transform the oil curse into oil blessing. A monumental treatise, Ross contends that it is also, indeed, especially applicable to new oil-producing countries because they have a chance to make a difference (Ross, 2012, p. 14).

Beyond academia, the oil curse has been dissected in the media as well. Consider The Economist. It blames the oil curse for much of what is wrong with Africa. For instance, in Sub-Saharan Africa, there are chronic shortages of fossil energy. Most oil rich African states do not maintain healthy crude oil reserves - the standard is 90-day of consumption. African refinery capacity has fallen by 50 per cent in the last decade. As such almost all the crude is exported and subsequently then imported back again as refined petroleum. Oil dependent states are vulnerable to the vicissitudes of oil pricing. (The Economist, 2021, p. 35). Proponents also point to irresponsible state use of fiscal revenues as a bane. Before it abruptly removed subsidies last year (2023) the Government of Nigeria spent as much as US$600m a month on fuel subsidies. It was a financial burden it could no longer afford to pay.

Indeed, this state irresponsibility has long been blamed for the oil curse. Sir Paul Collier makes similar claims in The Bottom Billion (Collier, 2007) that blames state irresponsibility and corruption as the problem. In its Guide on Resource Revenue, the International Monetary Fund (IMF) says - ‘Given the potentially substantial costs of non-transparent practices, institutional strengthening to improve transparency in vulnerable resource-rich countries should provide ample pay-off for a relatively modest investment. ‘…transparency can help establish and maintain credibility in regard to the collection and distribution of resource revenue’ (IMF 2007, p.4).

But this historical diagnosis is contested. Chibuzo Nwoke in his 1987 magnum opus Third World Minerals and Global Pricing: A New Theory and many other works (Nwoke, 1984a; 1984b; 1986, 1987, 2020; Collins, 2017) demonstrated the limits to that approach. At that time, as Nwoke noted, the Global North and the Global South were locked together in a tight world system. The fate of these two, the global south as the exporter of its own mineral riches and the Global North as the consumer of the fruits of the South, was tied together in a world system in which the gains from this ‘trade’ were skewed in favour of the North. There was, in fact, a distribution of benefits from the South to the North in a process which is sanctioned militarily either directly or indirectly by the countries from which the TNCs have emerged. Legal discourses of the sanctity of contracts were fetished so that initial contracts that were so unfavourable to the South and upheld the view that TNCs owned ‘Third World minerals’. Because such contracts were so sacrosanct, no changes were warranged, it was argued. The outcome of this maldistribution, Nwoke argued, was precisely the underdevelopment of Africa and the unjust enrichment of the North. Nwoke insisted that nationalisation was important then for a truly autonomous and independent development.

More recent accounts suggest that Michael Ross’ history of the tensions and contradictions of oil-based development must be nuanced. Both Daniel Yergin (2009) and Bianca Sarbu (2014) outline various strategic returns to the poorer producer nations that embarked on nationalisation, suggesting that nationalisations could not have been so uniformly disastrous for the peoples of the Global South. In any case, while Ross’ (2012) observation that the period immediately before nationalization was a Golden period seems factual, but its causal claims are disputed. Cyril Obi (2023, pp. 96-100), for instance, attributes it to the dogged national developmental state planning system prevalent at the time. That model of development would later be undermined as transnational corporations later asserted their power, bolstered by that of their country governments. The TNCs got states to implement low rates of taxation but, in general, it was low, not high, revenues that resulted (for a review, see Moore et al., 2018) from the implementation of that Laffer theory.

Even so, in Oil, Democracy, and Development in Africa, J.R. Heilbrunn (2014) argues that Africa’s resources continue to be assets that cannot be labelled as accursed, if we take into account the nature of institutions at the time of oil discovery, the phase of oil production, and colonial legacy. Overall, these resources, for Heilbrunn, are, in fact, a blessing, because without them, economic conditions in Africa would have been so much worse. To unleash the full potential of oil, Heilbrunn (2014) recommends the establishment of sovereign wealth funds – inspired by Milton Friendman’s permanent income hypothesis - to wheel Africa into the future.

A surprising point of contention and agreement between the oil curse/oil blessing debate relates to the size and the source of the revenues and how those make rulers unaccountable. This implies that both sides would agree that a Citizens’ Wealth Fund is the answer, but is it? Some answers might be gleaned from Angela Cummine’s (2016) recent work on the subject. Citizens’ Wealth probes whether Adam Smith’s ‘wealth of nations’ is the wealth of states or the wealth of citizens. Using a principal-agent framework, she contends that the wealth is for the principal, citizens, but the state acts as an agent that works in the best interest of its people. ‘Sustainable growth’ seems to be an important commitment (long-term use of citizens’ resources – much like Milton Friedman’s ‘Permanent Income Hypothesis’ for exhaustible resources) and, like Thomas Piketty, the question of inequality is seen more as a domestic issue.

Setting aside the history of inequality, these attempts are extractivist ‘resource-based development. As Joe Collins (2022) has recently clarified, extractivism is defined as a particular capitalist approach to global development in which resources are used to transform the economy. The resource curse/blessing approach, which debates the distribution of gains and losses from extractivism, is fundamentally limited. That is because neither resource curse nor resource blessing fundamentally questions extractivism.

An approach that examines property relations is a formidable alternative. This is because land ownership takes a particular form under capitalism. If mining is done on communal land and without private land ownership, then that activity does not, prima facie, amount to extractivism.

Crude Business

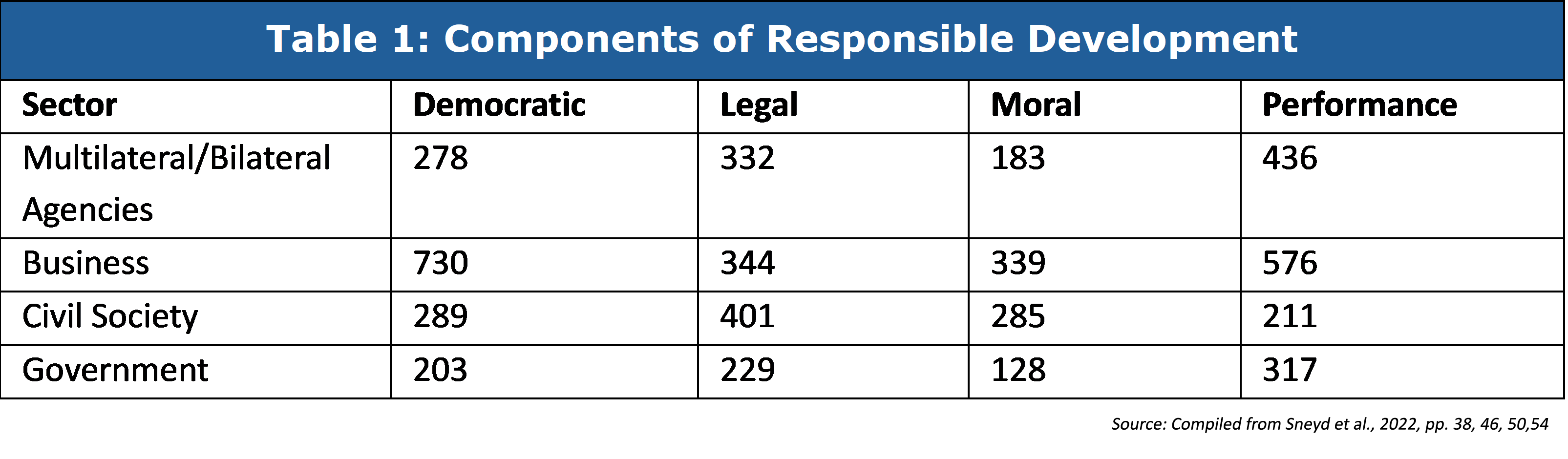

What, then, can address the problem? Responsible Resource-Driven Development (Sneyed et al., 2022, p.61) is one view. It posits that resource abundance and dependance in Africa will be a blessing if certain conditions of responsibility are met. These include democratic and legal protections to moral obligations (Table 1).

As Table 1 shows, in Cameroon and Central African Republic at least, official reports of various sectors (multilateral/bilateral agencies, business, civil society, and government) canvass this view. If only the oil sector could be democratic, more legal, more moral, and show more effective performance, using resources in Africa will bless the continent.

As Table 1 shows, in Cameroon and Central African Republic at least, official reports of various sectors (multilateral/bilateral agencies, business, civil society, and government) canvass this view. If only the oil sector could be democratic, more legal, more moral, and show more effective performance, using resources in Africa will bless the continent.

Among those sectors that hold the view that RRD will turn resource curse into blessing, ‘powerful actors … are often able to impose their framing of responsible conduct on others. Each of our empirical chapters unpacks complex power dynamics between different commodity stakeholders in relation to responsibility and draws attention to asymmetrical power relations in global value chains … We show how actors operating at the national and multinational scale tend to wield more power than local actors in determining what counts as responsible commodity investment (Sneyd et al., 2022, pp.223-224).

This is not all without any checks, as noted by the authors. ‘However, we also reflect on how power relations can change in response to consumer demands or to overwhelming public pressure. At those moments – even in Cameroon’s authoritarian state – those who hold less power may momentarily seize the opportunity to intervene and influence responsible business practice’ (Sneyd et al., 2022, p.224).

Even so, Adam Sneyd and his colleagues (2022) contend that improving the conditions of workers is the single most important condition for institutionalising a resource bless. This is especially important because there is significant worker dissatisfaction in the extractives sector. In Ghana, for instance, much research (e.g., Obeng-Odoom, 2014; Ablo, 2022; McQuinn and Sallah, 2022) has shown workers’ striking and protesting for that reason. If so, when mining companies better take care of their workers, might that be a model case? The Economist (2021b, p. 26) calls all such attempts to fix oil-related problems ‘crude business’. This business can also include Ross’ (2012) proposal of exchanging oil, which African countries have in abundance, for cash or capital, which is relatively scarce.

The case of Ghana is instructive. Not only has the country launched major oil buy-back schemes (The Economist, 2021b, p.26), but also the state borrows against new oil discoveries and expectations of increasing oil prices. This crude business includes betting on oil. Ghana has implemented a flurry of tax cuts in the hope that should create the enabling market for private sector participation and increased state revenues. Here the state has also expended quite widely to expand human capital and create the conditions for capital accumulation. But as recent research published in Development and Change (Akolgo, 2024) shows, none of these strategies has improved macroeconomic stability. Instead, national debt is on the rise, with debt to GDP percent rising from 54 in 2017 to 98.7 in 2023, making the country extremely vulnerable to both exchange rate and interest rate volatility (Akolgo, 2024). Most of this indebtedness is to Western creditors. This trend undermines not only economic stability, but also national security.

For Commodity Politics, that new way to reversing the oil curse is improving the conditions of workers. Not only is that propitious, it also has ‘the potential to serve as a model for positive change not just in Cameroon, but also in the broader Central African region and the tropical sugar sector as a whole’ (Sneyd et al., 2022, p.172). This is because, based on worker protests and resistance, the conditions of workers improved, rural development advanced, French transnational company (TNC), SOSUCAM or Soci ́et ́e Sucri ́ere du Cameroun, became more responsible at communicating and even more effective at upgrading health and education facilities (Sneyd et al., 2022, pp.147-173). The TNC exercises monopolistic control of sugar in Cameroon. Thus, this contention give the imprimatur for monopolies to sprout and spread. It is, somewhat, similar to Ross’ (2012) suggestion that the status quo, the global order in which transnational oil companies were in charge, was a golden period, a period during which irresponsibility was at bay because TNCs were more reliable governments. This position – suggesting that the crises arose from government failure - is also canvassed by mainstream economists (see, for a discussion of the neoclassical economics view, Obeng-Odoom, 2019).

Nature’s Gift and Common Future

I consider resource curse, oil curse, or responsible resource-driven development a major distraction. The question of state or private ownership, how best to secure the revenues for the benefit of citizens, how to avoid the oil curse, and all the many practical recommendations less useful. A few analysts take this view, too, but for different reasons. For Jerven, it is because of data problems: the data on which the resource curse claims are based are of poor quality. The use of higher quality data, Morten Jerven (e.g., Jerven 2015) contends, could lead to fundamentally different analyses of African economies. I discuss this data problem in Property, Institutions, and Social Stratification in Africa (Obeng-Odoom, 2020). Morten Jerven and I also debated the issue.

For me, the weakness in these explanations is that they frame Africa’s challenges in the wrong way. Africa’s problems are not fortuitous. If rent were shared all would prosper - especially if labour and capital were not saddled with unnecessary and burdensome taxes. According to this theory of Nature’s Gifts (Pullen, 2014), these taxes when placed on trees, can lead to deforestation, as was the case in Egypt many years ago.

As I argue in The Commons in an Age of Uncertainty, the trouble is rent theft, not wage theft. Foundational questions about land and its centrality to autonomy and freedom as well as how the control of land undermines sovereignty. Whether in Cameroon[1], Ghana, Nigeria, or anywhere else in Africa (Obeng-Odoom, 2020), yet these rent-based questions are glossed over or treated as secondary to the labour question, the capital question and, even worse dismissed as cultural problems. Sure, the improvement of working conditions and introduction of healthcare facilities and schools in rural areas is welcome (Sneyd et al., 2022, pp.147-173), but they do not provide compelling explanation or redress. The fundamentals of development and change remain in tact.

As I have argued in The Commons in an Age of Uncertainty, my own conceptualisation of the problem is centred on rent and its redress must be collective, but its construction of time and space must be broader. Historical injustices on all scales, local, regional, and global, are central and the analysis of inequality is fundamental. A social fund is necessary, but the one I propose, which can also hold ecological reparations, is a commons fund targeted at addressing inequalities and social stratification through ending ‘rent theft’, strengthening sovereignty, and supporting long-term ecological sustainability. I argue that ‘just land’ avoids the problem of ‘rent theft’.

Of course, collectivism can be quite seductive. So, we need to avoid applying it consistently as the one and only solution to every problem. Commoning the land, that is, collectivising the private appropriation of socially created rent, raises different sets of political-economic issues to, say, collectivising labour. Without this nuanced approach to analysing development and underdevelopment in Africa, one-size-fits-all will not do. It certainly is not how to even address the labour question nor the question in the commons debates. It is what we do with rent that is at the heart of the struggle, not ‘responsible resource-driven development’.

Franklin Obeng-Odoom is Professor of Global Development Studies, University of Helsinki, Finland. He is a winner of the Kurt Rothschild Award for Economic Research and Journalism. Contact: franklin.obeng-odoom@helsinki.fi

References

Ablo, A. 2022 ‘Carceral Labour: Offshore Work Relations, Conflicts and Local Participation in Ghana’s Oil and Gas Industry’, Political Geography, vol. 93, no.102556, pp. 1–8.

Alssadek M and Benhin J, 2023, ‘Natural resource curse: A literature survey and comparative assessment of regional groupings of oil-rich countries’, Resources Policy, vol. 84, 103741, pp. 1- 23.

McQuinn M and Sallah F.M.K., 2022, ‘Oil in Ghana: The Work of the General Transport, Petroleum and Chemical Workers’ Union (GTPCWU)’, Global Labour Journal, vol. 13, no. 2, pp. 187-208.

Auty, R. 1993, Sustaining Development in Mineral Economies: The Resource Curse Thesis. London: Routledge.

Abotebuno Akolgo, I. 2023, ‘Ghana's Debt Crisis and the Political Economy of Financial Dependence in Africa: History Repeating Itself?’, Development and Change, vol. 54, pp. 1264-1295.

Brueckner M, Durey A, Mayes R, and Pforr C, 2013, Resource Curse or Cure? On the Sustainability of Development in Western Australia, Springer, Heidelberg, New York, Dordrecht, London.

Collier, P, 2007, The Bottom Billion: Why the Poorest Countries are Failing and What Can Be Done about It, Oxford: Oxford University Press.

Collins J, 2017, ‘Towards a Socially Significant Theory of Rent’, Geography Research Forum, vol. 37, pp. 148 – 165.

Collins J, 2022, ‘Reversing Australia’s Resource Curse? No Such Luck…’, Journal of Australian Political Economy, no. 89, Winter, pp. 7-31.

Cummine A, 2016, Citizens’ Wealth: Why (And How) Sovereign Funds Should be Managed by the People for the People, Yale University Press, New Haven and London.

Heilbrunn J.R. Oil, 2014, Democracy, and Development in Africa, Cambridge University Press, Cambridge and New York.

International Monetary Fund, 2007, ‘Guide on Resource Revenue Transpar- ency’, IMF.

Jain A, 2021, ‘Papua New Guinea a warning for poor nations rich in natural resources’, NikkeiAsia, https://asia.nikkei.com/Opinion/Papua-New-Guinea-a-warning-for-poor-nations-rich-in-natural-resources (accessed on May 20, 2024).

Jerven, M. 2015. Africa: Why Economists Get it Wrong. London: Zed Books.

Laffer, A. B.,1981, ‘Supply-Side Economics’ Financial Analysts Journal, 37(5), 29– 43

Laffer, A. B., 2004, ‘The Laffer Curve: Past, Present, and Future’, The Heritage Foundation, no. 1765, June 1.

Nwoke, C. N. 1986, “Towards authentic economic nationalism in Nigeria.” Africa Today, 33(4): 51–69.

Nwoke, C. N., 1984a, “The global struggle over surplus profit for mining: A critical extension of Marx’s rent theory.” Ph.D. Dissertation, Graduate School of International Studies, University of Denver, USA.

Nwoke, C. N.,1984b, “World mining rent: An extension of Marx’s theories.” Review, 8 (1): 29–89.

Nwoke, C.N., 2020, ‘Rethinking the idea of independent development and self-reliance in Africa’, African Review of Economics and Finance, vol. 12, no. 1, pp. 152-170.

Obeng-Odoom F, 2014, Oiling the Urban Economy: Land, Labour, Capital, and the State in Sekondi-Takoradi, Ghana, Routledge, London

Obeng-Odoom F, 2019, ‘Oil, local content laws, and paternalism: Is economic paternalism better old, new, or democratic?’, Forum for Social Economics, vol. 48, no. 3, pp. 281–306.

Obeng-Odoom F, 2020, Property, Institutions, and Social Stratification in Africa, Cambridge University Press, Cambridge and New York.

Obeng-Odoom F, 2021, The Commons in an Age of Uncertainty: Decolonizing Nature, Economy, and Society, University of Toronto Press, Toronto.

Obi C, 2023, ‘Resource Curse’, in Obeng-Odoom F, Handbook on Alternative Global Development, Edward Elgar, Chichester, pp. 91-106.

Pullen J, 2014, Nature’s Gifts: The Australian Lectures of Henry George on the Ownership of Land and Other Natural Resources, Desert Plea Press, Sydney.

Ross M, 2012, The Oil Curse: How Petroleum Wealth Shapes the Development of Nations, Princeton University Press, New Jersey.

Sarbu B, 2014, Ownership and Control of Oil, Routledge, London.

Selemane T, 2022, ‘Mozambique’s Coal Implosion Amidst Global Climate Catastrophe’, Journal of Australian Political Economy, no. 89, pp. 67-89.

Sneyd A, Hamann S, Enns C, and Sneyd, L. Q, 2022, Commodity Politics: Contesting Responsibility in Cameroon: McGill-Queen’s University Press, Montreal and Kingston, London, Chicago.

The Economist, 2021a, ‘Africa’s Fuel Market: Pumped Dry’, in The Quantified Self, The Economist, May 7th – 13th, p. 35.

The Economist, 2021b, ‘Ghana’s Oil Buy-Back: Crude Business’, in , The Economist, August 14th – 20th, p. 26

The Economist, 2022a, ‘Uganda: Pipe Dreams’, in How High Will Interest Rates Go?, The Economist, February 5th – 11th, pp. 31-32.

The Economist, 2022b, ‘Nigeria and Its Oil: Steal It, Burn it, Lose it’, in Getting the Job Done: How Ukraine can Win, The Economist, September 17th -23rd, pp. 30-31.

Yergin D, 2009, The Prize: The EPIC Quest for Oil, Money and Power, Free Press, New York, London, Toronto, Sydney.

Citation

[1] Partner Africa, 2017, ‘TCCC Review of Child labour, Forced Labour and Land Rights in Cameroon’, https://www.coca-colacompany.com/content/dam/company/us/en/policies/pdf/human-workplace-rights/addressing-global-issues/sugar-study-camaroon.pdf Ashukem J-CN., 2019, A Rights-Based Approach to Foreign Agro-Investment in Cameroon: Enhancing the Protection of Local Communities’ Rights. Journal of African Law. 2019;63(2):163-191. Fonjong L, Sama-Lang I, Abonge LFC, 2017, ‘Large-Scale Land Acquisition and its Implications for Women’s Land Rights in Cameroon’, the International Development Research Centre, Ottawa

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)