Electric Vehicles: Africa’s battery minerals and GVC opportunities

African countries are not yet significant participants in the global value chain (GVC) of electric vehicles (EVs).

By Rafiq Raji

Introduction

A major component of an EV is the lithium-ion battery (LIB) that powers it. The pack of battery itself can make up anything between a third to half of the EV’s total cost.[1] The battery cells constitute about 60-80% of the cost of the battery pack, with the battery shells, other battery modules, battery management system, on-board charger, and DC/DC converter making up for the remainder.[2] Cell costs are roughly divided into two halves between raw materials and manufacturing, however (TIPS, 2021).

Key LIB minerals are available in ample quantities in South Africa (manganese, nickel and platinum), Democratic Republic of Congo (DRC) (cobalt), Zimbabwe (lithium), Mozambique (graphite) and Zambia (copper). While these minerals are mined in Africa the actual value-addition work such as smelting, refining, cell assembly and ultimately the EV production take place outside the continent. Africa thus loses out on higher returns on job-creation that occurs from participating in value creation. The Southern African Development Community (SADC) is perhaps the only region that could move forward along the LIB GVC. It has put plans in motion towards this goal.

In the mining industry the treatment of raw material to improve its physical or chemical properties, especially in preparation for smelting, is known as beneficiation. It is the first step towards climbing the value chain in the extractive industry.

The article attempts to address the following questions: (1) How feasible is it for mineral-producing African countries to forward integrate along the LIB GVC? (2) How can foreign firms facilitate beneficiation in Africa? (3) What should African governments do to encourage the mostly Chinese LIB minerals miners towards greater beneficiation on the continent?

What is Africa’s current position in the LIB GVC?

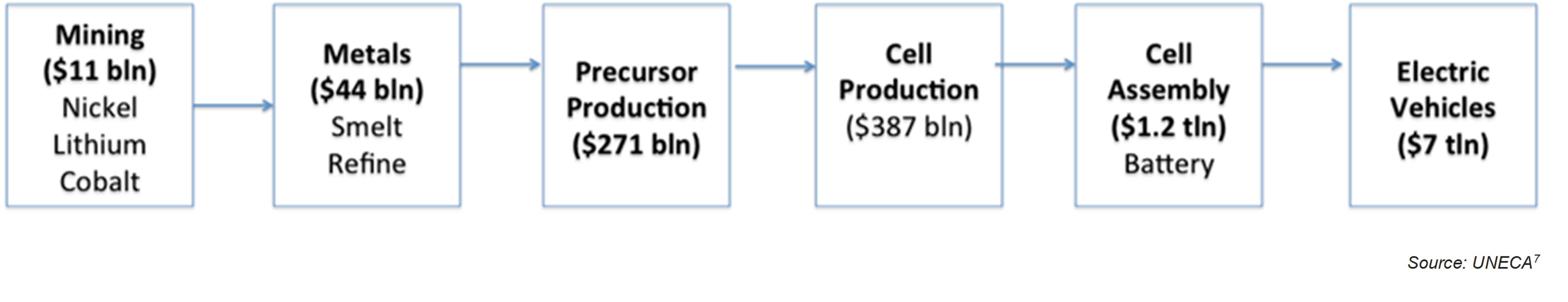

According to the International Energy Agency (IEA), demand for minerals critical to the energy transition to renewables could increase by as much as six fold by 2040.[3] With the African Continental Free Trade Agreement (AfCFTA), a regional LIB GVC involving the DRC and SADC countries could be globally competitive.[4], [5], [6] As shown in Figure 1, downstream value-add in the LIB GVC is exponentially higher than upstream mining and refining. African countries can not only aspire to participate in the beneficiation stages but also in the precursor production, cell production stages, and ultimately cell assembly.

Figure 1: The Battery Minerals and Electric Vehicles value chain

Much of the global reserves of critical minerals required for manufacturing EV batteries are in the DRC, Zimbabwe, Mozambique, Zambia and South Africa. No surprise, therefore, that these countries seek a greater portion of the pie. But the strategy thus far, in the case of the DRC, at least, seems to be about negotiating mining royalties on more favourable terms.[8] A more important priority for African countries should be to incentivise mining firms towards doing more of the beneficiation in situ. To move forward with such an agenda, however, some important human rights and regulatory concerns need to be addressed first. The use of child labour for mining cobalt in the DRC is probably top of the list.[9], [10]

Much of the global reserves of critical minerals required for manufacturing EV batteries are in the DRC, Zimbabwe, Mozambique, Zambia and South Africa. No surprise, therefore, that these countries seek a greater portion of the pie. But the strategy thus far, in the case of the DRC, at least, seems to be about negotiating mining royalties on more favourable terms.[8] A more important priority for African countries should be to incentivise mining firms towards doing more of the beneficiation in situ. To move forward with such an agenda, however, some important human rights and regulatory concerns need to be addressed first. The use of child labour for mining cobalt in the DRC is probably top of the list.[9], [10]

A lithium-ion battery consists of four key components: cathode, anode, electrolyte and separator.[11] The cathode consists of chemical materials that react with each other to generate an electric current. The most commonly used LIB cathode material is Lithium Nickel Manganese Cobalt Oxide (NMC).[12] Other LIB cathode materials are Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Iron Phosphate (LFP) and Lithium Nickel Cobalt Aluminium Oxide (NCA). On the other hand, the anode, which facilitates the flow of the electric current generated by the cathode through an electric circuit consists mostly of graphite. Lithium salts, mixed with solvents are the commonly used electrolytes or conduction medium. (See Table 2 for a snapshot.)

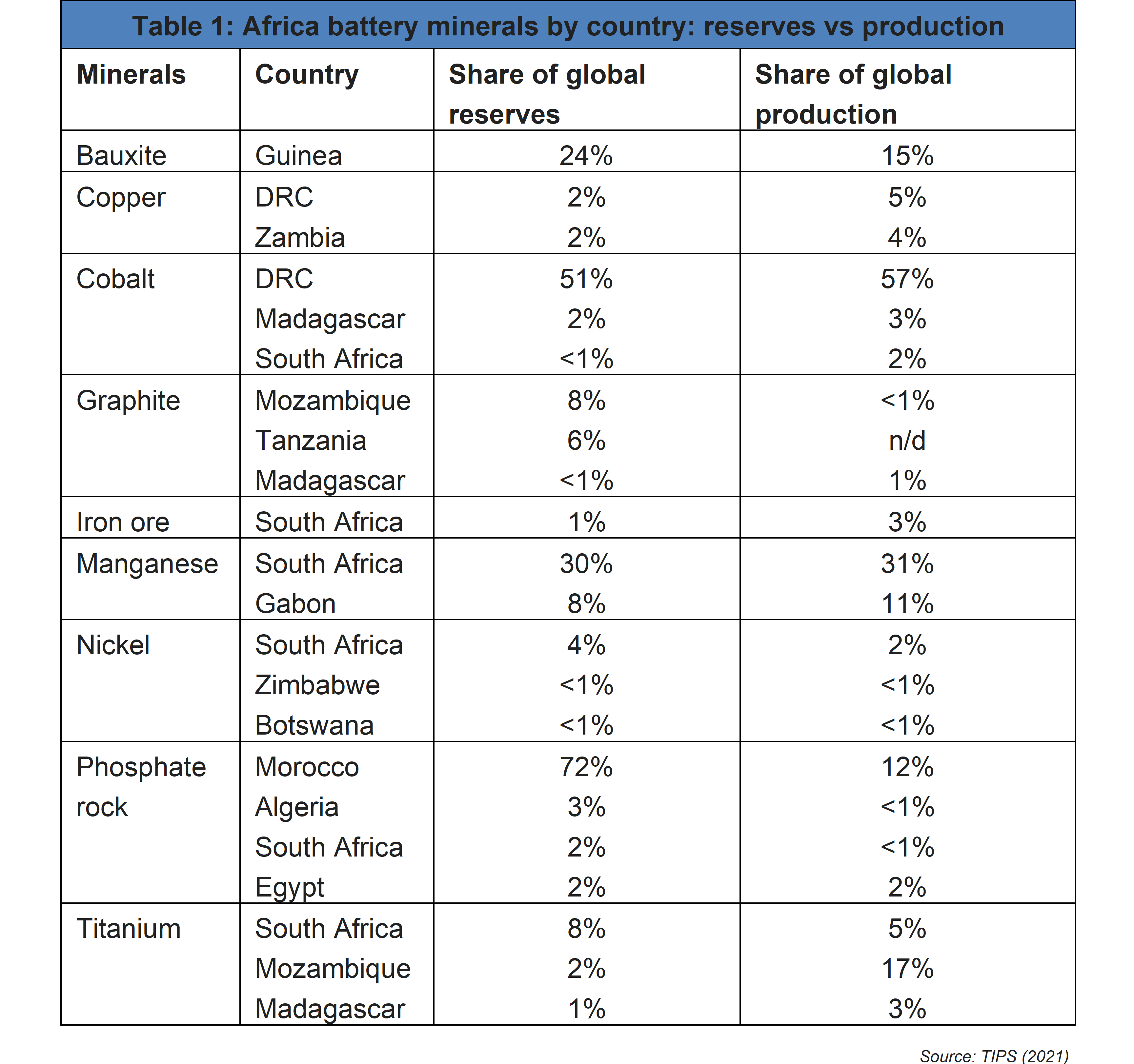

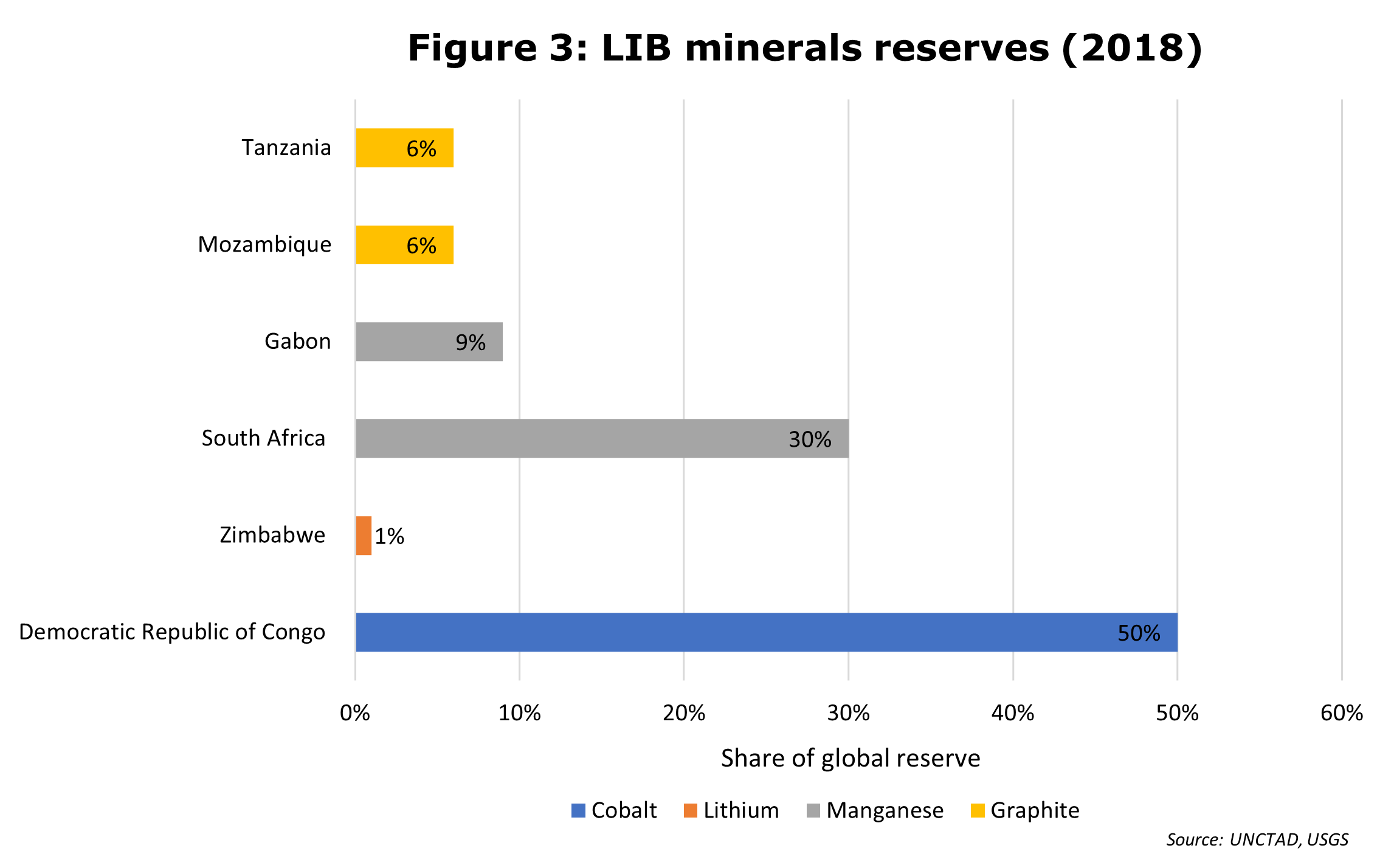

The key minerals that constitute a lithium-ion battery are lithium, cobalt, manganese, and natural graphite of which African countries hold a significant share of the global reserve (Figure 3).

Cobalt is largely a by-product of copper and nickel mining, with more than half of global reserves in the DRC where child labour is rife and violent political conflicts are frequent.[13] According to UNCTAD, Chile accounts for more than half of global lithium reserves, with Turkey and China together making up a similar share of reserves for graphite. South Africa and Gabon account for 39% of world manganese reserves, while Australia, Brazil and Ukraine account for 46% (UNCTAD, 2020).

Cobalt is largely a by-product of copper and nickel mining, with more than half of global reserves in the DRC where child labour is rife and violent political conflicts are frequent.[13] According to UNCTAD, Chile accounts for more than half of global lithium reserves, with Turkey and China together making up a similar share of reserves for graphite. South Africa and Gabon account for 39% of world manganese reserves, while Australia, Brazil and Ukraine account for 46% (UNCTAD, 2020).

Refined cobalt is produced in three forms: chemicals, powder and metals. For LIBs refined cobalt chemicals are the ones sought to combine with other refined mineral components like manganese or aluminium to make the cathode element (Farchy and Warren, 2018). While Impala Platinum of South Africa and Gecamines of the DRC produce some refined cobalt chemicals, 350MT and 200MT respectively, they are relatively minuscule compared to the global total of more than 64,000 MT.[14] In fact, according to 2017 data sourced from Darton Commodities Ltd, more than 80% of global cobalt chemical refining capacity is in China (Farchy and Warren, 2018).

Fundamentally, there is demonstrable expertise of cobalt chemical refining on the continent. Thus, the issue is scale and whether there are sufficient economies for doing so. There is currently significant research effort being put towards finding alternatives to pricey cobalt, or at least reduce the proportion needed in LIBs. In fact, global automaker VW, EV manufacturers Tesla and BYD are reportedly at advanced stages of developing cobalt-free batteries.[15]

But even as getting as much performance with less cobalt continues to be the focus of determined research efforts, cobalt is likely to remain a key component of LIBs for a little long while.[16] Owing to cost savings, some EV OEMs like Tesla do not mind using lower cobalt chemistries, however.[17] It certainly highlights the imperative for the DRC, which accounts for more than half of global cobalt reserves, to ensure cobalt remains an attractive proposition.

The typical mining value chain for extracting these minerals consists principally of (1) mine initiation activities, (2) mineral extraction and beneficiation, and (3) refining and recycling.[18] In most cases, however, beneficiation and refining take place outside the continent. This should not be the case. Take Chile, for example. That is where most of the global lithium reserves are mined. It is also where most of its refining takes place (UNCTAD, 2020). With ample graphite reserves in Mozambique and Tanzania, there is no reason why refined graphite should not be similarly produced in those African countries. In the case of manganese, South Africa, which accounts for a significant share of global reserves, already has demonstrable refining capacity. But it still exports more than 80% of its manganese ore for beneficiation abroad (TIPS, 2021).

The LIB manufacturing process involves three main stages: (1) electrode preparation (2) cell assembly and (3) battery electrochemistry activation.[19] There is currently no African country where any of these LIB manufacturing stages takes place on a commercial scale.[20] Japan’s Panasonic, China’s CATL and South Korea’s LG Chem are the current leading global EV LIB manufacturers (See Figure 4). The top global LIB cathode manufacturers are Umicore, BASF, and Johnson Matthey.[21] Asian manufacturers dominate LIB anodes. These include giant firms like Hitachi Chemical, BTR, Shanshan Technology, JFE, Mitsubishi Chemical Holdings, and Nippon Carbon (UNCTAD, 2020).

The LIB manufacturing process involves three main stages: (1) electrode preparation (2) cell assembly and (3) battery electrochemistry activation.[19] There is currently no African country where any of these LIB manufacturing stages takes place on a commercial scale.[20] Japan’s Panasonic, China’s CATL and South Korea’s LG Chem are the current leading global EV LIB manufacturers (See Figure 4). The top global LIB cathode manufacturers are Umicore, BASF, and Johnson Matthey.[21] Asian manufacturers dominate LIB anodes. These include giant firms like Hitachi Chemical, BTR, Shanshan Technology, JFE, Mitsubishi Chemical Holdings, and Nippon Carbon (UNCTAD, 2020).

China controls 80% of global LIB minerals refining, 77% of cell production and 60% of components manufacturing (Table 5). It is expected to remain dominant for at least another five years.[22] South Africa and the DRC rank high for LIB raw materials but fall short for cell and component manufacturing as well as regulations, infrastructure and innovation.

China controls 80% of global LIB minerals refining, 77% of cell production and 60% of components manufacturing (Table 5). It is expected to remain dominant for at least another five years.[22] South Africa and the DRC rank high for LIB raw materials but fall short for cell and component manufacturing as well as regulations, infrastructure and innovation.

Southern Africa is best positioned for LIB GVC

With LIB downstream GVC operations already well-established in Asia the realisation of Africa’s ambition for greater value-add may depend on greater EV adoption on the continent itself. In my previous article “Electric Vehicles: An ironic African opportunity?” (NTU-SBF Centre for African Studies, 14 Apr 2021) I estimated there could be as much as 50,000 to 300,000 of new EV sales happening each year in Africa by 2030.[23] But even that does not happen there is already a strong global demand for LIBs, regardless.

EV battery demand is expected to grow 15-fold to 2,576GWh by 2030, with global manufacturers expected to create 2,539GWh annual capacity by 2025.[24] Average battery pack prices are expected to fall below US$100/kWh on a volume-weighted average basis by 2024 and drop by another half to US$58/kWh by 2030 (BloombergNEF, 2021).

Thus, an ambition to mine the battery minerals, refine them, produce cells and assemble them into batteries for onward installation in EVs in a GVC that stretches from the DRC, Tanzania, Mozambique and through to the SADC region is not farfetched. It would, however, focus, determination, and a long-term commitment from African governments, firms and international partners. Despite significant constraints that exist around infrastructure, logistics, financing, and policy this ambition is realisable.[25]

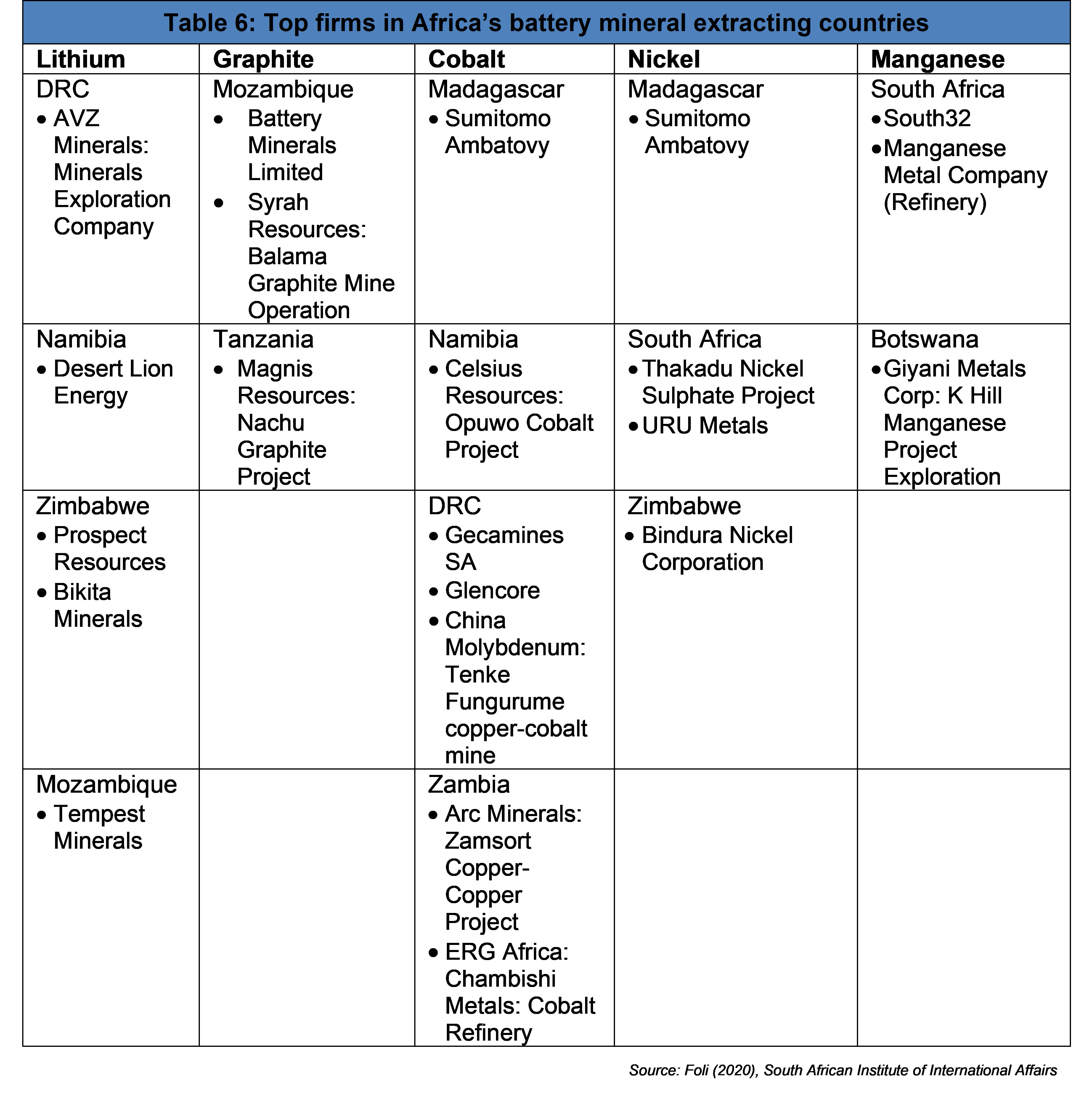

With the right incentives and economic conditions, the numerous local and foreign firms which currently mine key LIB minerals in the SADC region (see Table 6), could easily forward integrate their African operations. South Africa’s Manganese Metal Company (MCC) already produces high-grade electrolytic manganese metal for NMC cathode.26], [27]Thakadu Battery Minerals’ US$20m nickel sulphate refinery, which gets its primary crude feed stock from Sibanye-Stillwater, started production in South Africa in March 2021.[28] It can produce up to 30,000 tonnes of nickel sulphate per annum.

With the right incentives and economic conditions, the numerous local and foreign firms which currently mine key LIB minerals in the SADC region (see Table 6), could easily forward integrate their African operations. South Africa’s Manganese Metal Company (MCC) already produces high-grade electrolytic manganese metal for NMC cathode.26], [27]Thakadu Battery Minerals’ US$20m nickel sulphate refinery, which gets its primary crude feed stock from Sibanye-Stillwater, started production in South Africa in March 2021.[28] It can produce up to 30,000 tonnes of nickel sulphate per annum.

Zambia’s Chambishi and Madagascar’s Ambotovy, which process cobalt, do not produce exportable LIB-grade material, however.[29], [30] Operations at the Chambishi Metals Refinery have been suspended, owing to cobalt and copper concentrates supply shortages.[31] In Mozambique a joint venture to process graphite has been established between Australia’s Battery Minerals and American graphite processing giant Urbix.[32] Tanzania granted permission to Magnis Technologies in 2018 to process its graphite resources into value-added products.[33] The Zimbabwean government has set in motion plans for a lithium-ore processing plant in Bulawayo.[34]

There is increasing recognition and effort toward greater beneficiation of EV battery minerals in the SADC region. Progress has stalled, however, owing to significant barriers like skills shortage, inadequate financing, weak and limited infrastructure, sluggishness with industrial policy implementation, taxation, and a relatively small market (Foli, 2020).

South Africa is probably best placed to move forward the farthest in the shortest possible time. In January 2020 local battery firm Megamillion Energy Company announced plans to construct a US$35m 0.25 GWh lithium-ion battery production pilot plant in Coega. It plans to increase annual output to 32 GWh by 2028 - initially for energy storage but ultimately for EVs as well.[35] Operations are expected to commence in 2022.

According to Foli (2020), South Africa’s Council for Scientific and Industrial Research (CSIR), South African Nuclear Energy Corporation (NECSA), aluminium supplier Hulamin, and integrated energy and chemical company Sasol, “have the facilities and capability to make cell components for lithium-ion batteries.” What is stopping them from tapping the opportunity then? “There is currently no market in SADC for them to adapt their processes to make lithium-ion battery-related components,” he says.

Beyond cell component manufacturing South Africa also has scalable lithium-ion battery pack assemblers. Most of these, however, are for non-EV battery applications. These include the Durban-based Maxwell and Spark, which produce lithium-ion battery packs for forklifts and refrigeration trucks[36] and OEM Battery Powered Industries, which assembles LIB packs for underground mining equipment.[37]

As Africa accelerates adoption of EV adoption second-life repurposing and eventual recycling of EV batteries may become attractive. South Africa may be well placed to take advantage of this development. The uYilo e-Mobility Programme at the Nelson Mandela University in Port Elizabeth, South Africa, has capabilities for such repurposing activities.[38]

Significant synergies required to overcome challenges

Several challenges may need to be overcome if African participation in LIB GVCs is to succeed. There are not enough skilled human resources. Financing is also constrained. The much lamented infrastructure deficit on the continent is also a handicap. Although governments have recognised the opportunity and enacted industrial policies to support EV battery manufacturing, implementation has been somewhat slow. Sale of EVs in Africa is not yet large enough to justify substantial investments in producing LIBs locally. The Energy Storage Research, Development and Innovation (RDI) consortium, which was established in 2011 by South Africa’s Department of Science and Innovation in partnership with the country’s leading universities and research centres, for the development of a local LIB value chain, has since pivoted to simply developing skills and expertise, owing to an “inability to compete with leading countries.”[39]

Some of the other impediments are self-goals made by governments themselves. Take the case of the Eurasia Resources Group’s (ERG) Chambishi Metals refinery in Zambia, which has a capacity to produce 6,800 tonnes of cobalt metal per annum. The refinery has repeatedly faced difficulties importing cobalt and copper concentrate feedstock from the DRC. In February 2019, ERG Africa was forced to suspend operations at Chambishi after Zambia imposed a 5% duty on its feedstock imports.[40] A year later, in January 2020, operations were suspended owing to a shortage of feedstock.[41] The Chambishi case highlights the potential holdups around developing a regional LIB GVC in the SADC region. Even as the case for beneficiation is clear, the constraints holding it back are real.

There is currently no commercial production of battery cells in South Africa although battery manufacturing based on imported cells, itself, appears to be thriving . But Africa has all the raw materials needed to produce LIBs. That remains a potential comparative advantage in a global market that is expected to expand exponentially over the next ten years. By some estimates, battery manufacturing capacity may need to increase from 300 GWh in 2020 to at least 2,023 GWh by 2030 to meet the rising demand for EVs (Foli, 2020). The relatively small local market size need not be a disincentive. It is, however, unclear if Africa could move beyond the mineral beneficiation stage. Of the four identified GVC stages of LIB value chain - mineral refining, cell manufacturing, battery manufacturing and assembly and battery recycling - only mineral refining and battery manufacturing can be scaled up in South Africa for the moment (TIPS, 2021).

To move forward, African governments may need to follow in the footsteps Hong Kong, South Korea, Singapore and Taiwan. These Asian countries implemented industrial policies that gave rise to global conglomerates that are leaders in the automobile, electronics, and technology sectors today.

Chinese firms already dominate LIB minerals mining in Africa. Some of the leading global commodities firms like Glencore, which own mines across the continent, have their Asian hubs in Singapore. China and Singapore could thus facilitate financing, testing and certification, and access to global markets for African firms looking to move up the LIB value chain.

Conclusion and recommendations

This paper has established that while Africa remains a minor player in the LIB GVC it has the potential to participate in it. This is especially in the case of the SADC region. The case for more mineral beneficiation is robust but evidence suggests cell production, except for the local market, may not be globally competitive.

There are significant constraints around infrastructure, logistics, financing, and the policy environment. Only mineral refining and battery manufacturing have been found to be scalable, and that too only in South Africa for the moment. No firm in South Africa produces LIB cells commercially but a vibrant battery manufacturing industry that relies on imported cells does exist.

African governments would need to be more assertive when negotiating with global mining firms if they wish to enjoy the returns of beneficiation. They must enact industrial policies that favour LIB GVC. The dominant Chinese firms could almost certainly be steered towards reconfiguring their operations for more African participation. There is evidence of willingness for such partnerships if credible local partners make the move, as is the case with South Africa’s Megamillion, for instance.

But even with such partnerships it may make more economic sense to import battery cells rather than produce them locally – at least over the short term. There is simply no economy of scale at the moment to justify significant investments in cell manufacturing in Africa. Cell production pilot schemes are unlikely to evolve into large scale facilities anytime soon. But there is no reason why mining firms cannot refine battery minerals in Africa before exporting just as they do elsewhere. The in situ beneficiation of LIB minerals to battery-grade metals is a no-brainer. Governments and firms can act in partnership to remove the obstacles in the way of greater African participation in the LIB GVC.

I suggest the following:

1. Firms should position early

There is a window of opportunity until 2030 for African firms to prepare themselves before the sale EVs takes off. The beneficiation of minerals to battery-grade metals is an opportunity that firms can seize early. There is currently a strong desire by global firms to reduce dependence on China for LIB metals.

The diversification objective of non-Chinese firms could be served even if refined LIB metals were to be supplied by a Chinese-owned refinery in the DRC, say. Beyond 2030, the potential opportunities take on wider dimensions. Recycling of LIBs may take on greater importance and urgency by then, and thus become a lucrative opportunity for Africa. But there no point waiting. Best to start the groundwork early, ahead of the potential opportunity years later. Enterprise Singapore offices in the SADC region could help facilitate their firms position early and the government of Singapore could extend technical assistance to help African governments enact industrial policies that can facilitate greater value chain participation.

2. Governments should provide much needed support

There is much that African governments would need to do to encourage firms to add more value to LIB minerals in situ. For a start, governments should avoid imposing taxes that add to the costs of imported feedstock, for instance.

The Zambian Chambishi Metals refinery case is a cautionary tale that shows what happens when the action of the state is not aligned with its vision.

Within SADC the South African government seems to be the only one making significant efforts towards the greater African LIB GVC participation (Foli, 2020).

3. Battery consortia and collaboration with Singapore

The skills and financial capacity gaps that exist can closed with foreign partnership. Synergies may exist between the Singapore Battery Consortium (SBC) and South Africa’s Energy Storage Research, Development and Innovation Consortium (RDI), for instance. These could tapped for building out certification and regulatory frameworks in Africa. SBC member firm, Green Li-ion, which recently pioneered a technology which recycles LIBs into almost 100% pure cathodes, could just as well begin exploring opportunities on the continent as it is currently doing in Dubai and China.[42]

There may be opportunities for collaboration between Universities and think-tanks as well. SBC member, Nanyang Technological University (NTU), is already producing ground-breaking LIB research. NTU scientists have been able to successfully recover precious metals from battery waste using orange fruit peels and thereafter created functional batteries from the metals.[43] The uYilo e-Mobility Programme at the Nelson Mandela University in Port Elizabeth, South Africa, which is also a member of the RDI could be an ideal target for a potential partnership with NTU and SBC.

References

[1] Boudway, I. (2020, December 16). Batteries for electric cars speed toward a tipping point. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2020-12-16/electric-cars-are-about-to-be-as-cheap-as-gas-powered-models

[2] Building better batteries: Insights on chemistry and design from China (2021, April 22). McKinsey & Company. Retrieved from https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/building-better-batteries-insights-on-chemistry-and-design-from-china

[3] Frangoul, A. (2021, May 5). Electric vehicles and renewables will need a dramatic rise in mineral supply, IEA warns. CNBC. Retrieved from https://www.cnbc.com/2021/05/05/electric-vehicles-renewables-will-need-rise-in-mineral-supply-iea.html

[4] Gbadegesin, T. (2020, January 7). Africa must assume its place in the global battery race. The Africa Report. Retrieved from https://www.theafricareport.com/21865/africa-must-assume-its-place-in-the-global-battery-race/

[5] Martin, D. (2021, June 1). Time for South Africa to take a fresh look at the DRC. Daily Maverick. Retrieved from https://www.dailymaverick.co.za/article/2021-06-01-time-for-south-africa-to-take-a-fresh-look-at-the-drc/

[6] Trade & Industrial Policy Strategies (2021). Opportunities to develop the lithium-ion battery value chain in South Africa. Pretoria: TIPS. Retrieved from https://www.tips.org.za/images/Battery_Manufacturing_value_chain_study.pdf

[7] UNECA (2021). Facts & Figures: on cobalt, battery minerals and electric cars value chains. Addis Ababa: UNECA. Retrieved from https://www.uneca.org/sites/default/files/Africa-Business-Forum/4/Cobalt.pdf

[8] Bakumanya, B. (2021, May 14). DR Congo president says he will renegotiate mining contracts. Barron’s. Retrieved from https://www.barrons.com/news/dr-congo-president-says-he-will-renegotiate-mining-contracts-01621016413

[9] Campbell, J. (2020, October 29). Why cobalt mining in the DRC needs urgent attention. Council on Foreign Relations Blog. Retrieved from https://www.cfr.org/blog/why-cobalt-mining-drc-needs-urgent-attention

[10] World Economic Forum (2020). Making mining safe and fair: Artisanal cobalt extraction in the Democratic Republic of Congo. Geneva: WEF. Retrieved from http://www3.weforum.org/docs/WEF_Making_Mining_Safe_2020.pdf

[11] Unwin, J. (2019, May 15). What are lithium batteries and how do they work? Power Technology. Retrieved from https://www.power-technology.com/features/what-are-lithium-batteries-made-of/

[12] NMC batteries dominating EV - sales reach 63% of global market (2018, October 19). Mining.com. Retrieved from https://www.mining.com/nmc-batteries-dominating-ev-sales-reach-63-global-market/

[13] Azevedo, M., Campagnol, N., Hagenbruch, T., Lala, A. & Ramsbottom, O. (2018). Lithium and Cobalt – A tale of two commodities. McKinsey & Company. Retrieved from https://www.mckinsey.com/~/media/mckinsey/industries/metals%20and%20mining/our%20insights/lithium%20and%20cobalt%20a%20tale%20of%20two%20commodities/lithium-and-cobalt-a-tale-of-two-commodities.ashx

[14] Farchy, J. & Warren, H. (2018, December 2). China has a secret weapon in the race to dominate electric cars. Bloomberg. Retrieved from https://www.bloomberg.com/graphics/2018-china-cobalt/

[15] Olander, E. (2021, June 8). For the DRC, EV batteries without cobalt is bad news. The Africa Report. Retrieved from https://www.theafricareport.com/95739/for-the-drc-ev-batteries-without-cobalt-is-bad-news/

[16] Office of Energy Efficiency & Renewable Energy (2021, April 6). Reducing reliance on cobalt for lithium-ion batteries. Retrieved from https://www.energy.gov/eere/vehicles/articles/reducing-reliance-cobalt-lithium-ion-batteries

[17] Alves, D.P., Blagoeva, D., Pavel, C. & Arvanitidis, N. (2018). Cobalt: demand-supply balances in the transition to electric mobility. Petten: European Commission. Retrieved from https://publications.jrc.ec.europa.eu/repository/bitstream/JRC112285/jrc112285_cobalt.pdf

[18] United Nations Conference on Trade and Development (2020). Commodities at a glance: Special issue on strategic battery raw materials. Geneva: UNCTAD. Retrieved from https://unctad.org/system/files/official-document/ditccom2019d5_en.pdf

[19] Liu, Y., Zhang, R., Wang, J. & Wang, Y. (2021). Current and future lithium-ion battery manufacturing. iScience, 24 (4). Retrieved from https://www.sciencedirect.com/sdfe/reader/pii/S258900422100300X/pdf

[20] Eddy, J., Pfeiffer, A. & van de Staaij, J. (2019, June 3). Recharging economies: The EV-battery manufacturing outlook for Europe. McKinsey & Company. Retrieved from https://www.mckinsey.com/industries/oil-and-gas/our-insights/recharging-economies-the-ev-battery-manufacturing-outlook-for-europe

[21] Shelar, S. (2018, July 25). Embracing lithium-ion battery euphoria – “Innovations in cathode materials”. Battery Power. Retrieved from https://www.batterypoweronline.com/news/embracing-lithium-ion-battery-euphoria-innovations-in-cathode-materials/

[22] China dominates the lithium-ion battery supply chain, but Europe is on the rise (2020, September 16). BloombergNEF. Retrieved from https://about.bnef.com/blog/china-dominates-the-lithium-ion-battery-supply-chain-but-europe-is-on-the-rise/

[23] Raji, R. (2021). Electric vehicles: An ironic African opportunity? Singapore: Nanyang Business School. Retrieved from https://www.ntu.edu.sg/docs/librariesprovider100/aci-latest/2021-47.pdf?sfvrsn=7652eb60_2

[24] BloombergNEF (2021). Electric vehicle outlook 2021. BloombergNEF. Retrieved from https://about.bnef.com/electric-vehicle-outlook/

[25] Foli, E. (2020). SADC e-mobility outlook: Accelerating the battery manufacturing value chain (Occasional Paper No. 316). Johannesburg: South African Institute of International Affairs. Retrieved from https://saiia.org.za/research/sadc-e-mobility-outlook-accelerating-the-battery-manufacturing-value-chain/#

[26] Battery applications (n.d.). Manganese Metal Company. Retrieved from https://www.mmc.co.za/applications/batteries

[27] South Africa Department of Trade, Industry and Commerce (2020, June 19). Mineral beneficiation: Presentation to portfolio committee on trade and industry. Pretoria: The DTIC. Retrieved from http://www.thedtic.gov.za/wp-content/uploads/Beneficiation19-June2020.pdf

[28] Thakadu nickel sulphate refinery starts production (2021, March 9). Mining Review. Retrieved from https://www.miningreview.com/battery-metals/thakadu-nickel-sulphate-refinery-starts-production-in-south-africa/

[29] Chambishi Metals: A refinery producing LME primary cobalt metal and copper. ERG Africa. Retrieved from https://www.ergafrica.com/cobalt-copper-division/chambishi-metals/

[30] The ambatovy project, one of the world’s largest nickel projects. Sumitomo Corporation. Retrieved from https://www.sumitomocorp.com/en/jp/business/case/group/235

[31] ERG suspends Zambia refinery on shortage of cobalt, copper concentrates (2020, January 23). Reuters. Retrieved from https://www.reuters.com/article/us-erg-zambia-idUSKBN1ZM21R

[32] Battery Minerals to process graphite in Mozambique (2019, October 14). Club of Mozambique. Retrieved from https://clubofmozambique.com/news/battery-minerals-to-process-graphite-in-mozambique-144311/

[33] van Vuuren, R.J. (2018, March 9). Magnis Resources reaches consensus in Tanzania. Mining Review Africa. Retrieved from https://www.miningreview.com/battery-metals/magnis-resources-reaches-consensus-in-tanzania/

[34] Stevens, L.M. (2019, October 14). Zimbabwe’s lithium mine is attracting global attention. African Mining Market. Retrieved from https://africanminingmarket.com/zimbabwes-lithium-mine-is-attracting-global-attention/4906/

[35] Venter, I. (2020, January 20). Coega-based lithium-ion battery plant to open its doors this year. Engineering News. Retrieved from https://www.engineeringnews.co.za/article/coega-based-lithium-ion-battery-plant-to-open-its-doors-this-year-2020-01-20

[36] Venter, I. (2021, January 25). Electric truck refrigeration manufacturer looks to global market. Engineering News. Retrieved from https://www.engineeringnews.co.za/article/electric-truck-refrigeration-manufacturer-looks-to-global-market-2021-01-25

[37] About Us (n.d.). Battery Powered Industries. Retrieved from https://www.batterypowered.co.za/

[38] Electric vehicle smart grid ecosystem (n.d.). uYilo e-Mobility Programme. Retrieved from https://www.uyilo.org.za/facilities-services/smart-grid-ecosystem/

[39] TIPS (2021). Opportunities to develop the lithium-ion battery value chain in South Africa. Pretoria: Trade & Industrial Policy Strategies. Retrieved from https://www.tips.org.za/images/Battery_Manufacturing_value_chain_study_main_report_March_2021.pdf

[40] Radford, C. (2019, February 14). ERG suspends copper, cobalt production at Chambishi. Metal Bulletin. Retrieved from https://www.metalbulletin.com/Article/3858286/ERG-suspends-copper-cobalt-production-at-Chambishi.html

[41] Ignacio, R.J. (2020, January 23). Eurasian Resources to suspend Chambishi refinery due to concentrates shortage. S&P Global Market Intelligence. Retrieved from https://www.spglobal.com/marketintelligence/en/news-insights/trending/jjr252bm0dkjn60aadtfpw2

[42] Barker, K. (2020, August 11). Green Li-ion to launch first lithium-ion battery recycling technology in Singapore. Recycling Product News. Retrieved from https://www.recyclingproductnews.com/article/34573/green-li-ion-to-launch-first-lithium-ion-battery-recycling-technology-in-singapore

[43] Nanyang Technological University (2020, August 26). NTU Singapore scientists use fruit peel to turn old batteries into new [Press release]. Nanyang Technological University. Retrieved from https://www.ntu.edu.sg/docs/default-source/corporate-ntu/hub-news/ntu-singapore-scientists-use-fruit-peel-to-turn-old-batteries-into-new186197db-2a8f-40cc-ac84-4014a6203d71.pdf?sfvrsn=930478ee_3

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)