Financing the green transition for debt-constrained African countries

G20 and COP29 may provide another opportunity to advance climate finance mechanisms

By Rafiq Raji and Amit Jain

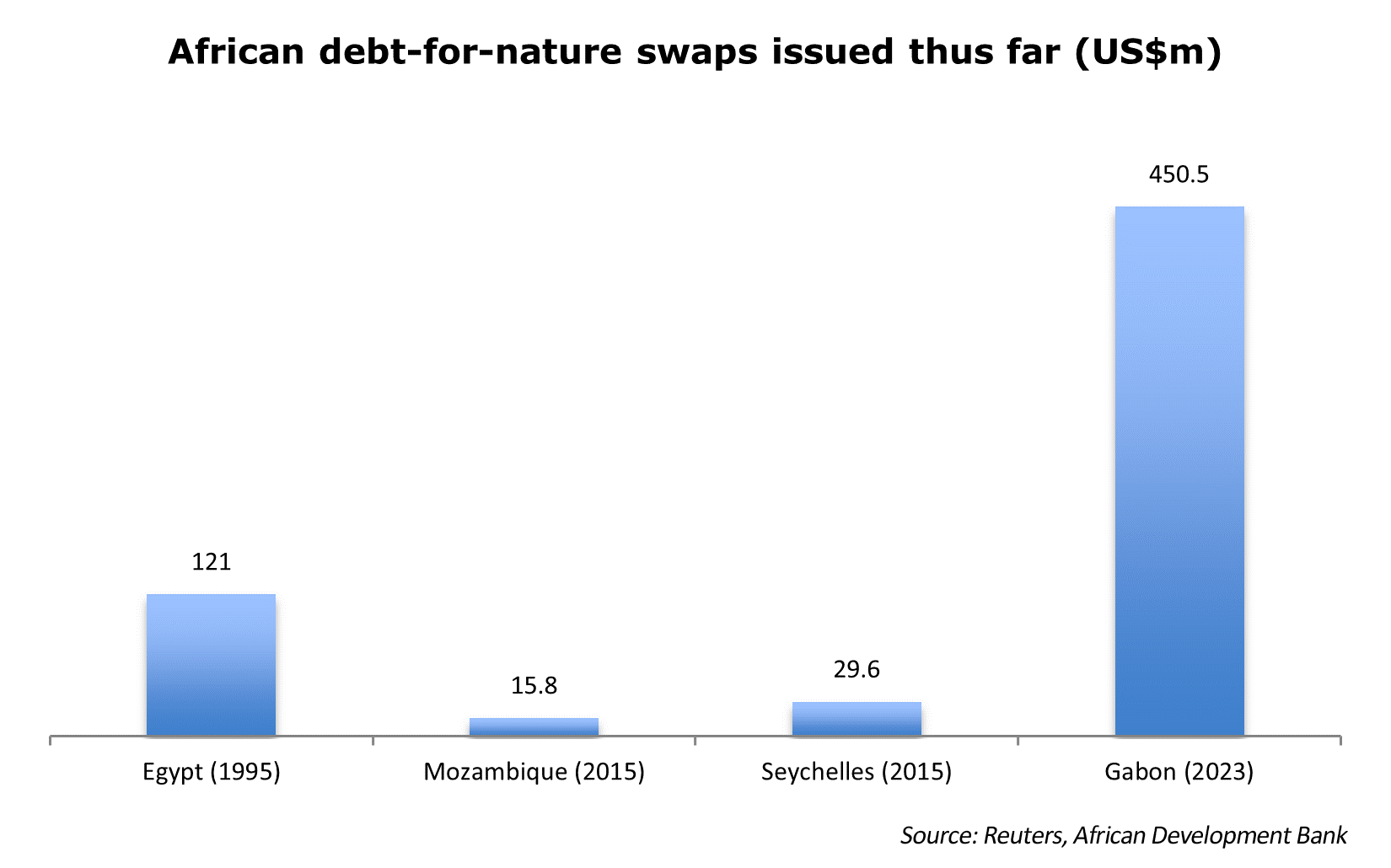

There is clearly a need to relieve African countries of some of their debt burdens, provide them with sustainable climate financing, and allow them exemptions on fossil fuels for energy and punitive carbon taxes on their international trade. Agreeing on global carbon pricing rules will be key in this regard, as will be debt-for-nature swaps, enabling African countries to use much more sustainable market-based approaches to finance their green energy transition. The G20 meeting and COP29 conference slated for mid-November will provide another opportunity to advance these mechanisms further. We highlight the ongoing efforts to make the global financial architecture better suited to the needs of developing countries, which have been suffocating from huge debt burdens, in part owing to unfairly priced loans and bonds, and insensitively high charges and fines on supposedly concessional debt. We expect the G20 to announce additional frameworks to ease the debt burdens of poor countries, after assessing the mixed progress of its Common Framework debt restructuring process thus far. There are also strong indications that common global carbon pricing rules might finally be agreed at COP29 in Baku this year. Global debt market participants are also increasingly warming up to debt-for-nature swaps, another potentially sustainable climate financing source for African countries.

Make the global financial architecture Africa-friendly

More African countries are expected to default on their debt over the next decade, according to S&P Global Ratings.[1] To avoid a lengthy debt restructuring process, as the G20 Common Framework has proven to be, rich countries, led by America, want an alternative pathway for debt-constrained countries, whereby they get enough relief to avoid default in the first place.[2] African countries face a double whammy of huge debt burdens and negative climate change externalities. Floods and droughts will weigh on the economic output of key countries like Nigeria and Zambia respectively this year, for instance, which will test the patience of their citizens, who hitherto were enduring painful economic reforms. The International Monetary Fund (IMF) has reduced charges on loans to indebted countries ahead of its October 2024 meetings, which is part of a bouquet of measures being considered by wealthy countries and global financial stakeholders to ease some of the burden that have been adjudged to be unfairly priced for poor countries, even though the new measures will apply to all IMF member countries, and reduce their borrowing costs by 36% or US$1.2bn annually.[3]

Rich countries are also considering measures to reduce the debt burden of hugely fiscally constrained poor countries, most of which are African, which will pre-empt defaults by easing terms of repayments and so on, as restructuring under the G20 Common Framework has proven to be lengthy, contentious, and uncoordinated; although the process has been improving incrementally.[4] The United States is pushing for the IMF, World Bank, and other multilateral development financial institutions (DFIs) to put together a package that will enable indebted countries committed to sustainable economic development to get liquidity support, net-present-value-neutral re-profilings, and other myriad creative approaches, such that they do not become so financially constrained as to divert funds for development to servicing debt.[5] This will not remove the debt restructuring process already in place via the G20 Common Framework, as this might be the must optimal solution in some cases, but multiple paths towards debt sustainability that are underpinned by a win-win approach for creditors and borrowers, will allow for some of the lost trust in the global financial system to be restored.[6] This philosophy is also guiding the recent move by the IMF to cut or eliminate surcharges on its loans, which hitherto added to the fiscal burden of debt-constrained countries that are relying on it for support. These new measures are in part due to resolutions from the Summit of the Futures by the United Nations (UN) in late September which argued for a reform of the global financial architecture, as in its current form, it is weighing on the futures of poor countries. Bretton Woods institutions like the IMF and World Bank risk losing their influence and utility to budding institutions being championed by the so-called Global South, especially BRICS, whose rising membership roll is beginning to ring alarm bells in Washington DC and other western capitals.[7]

The US$100bn annual climate finance pledge to poor countries by rich ones in 2009-20 was missed the entire time, only reaching the mark belatedly in 2022.[8] It is worth reiterating that the prosperity of today’s wealthy countries came at the expense of huge devastation to the planet, the consequences of which are now affecting everyone, especially poor countries, African ones chief amongst them, who have little means to mitigate them. Much more climate financing will be required by poor countries, it is now estimated, making it imperative for more sustainable market-based approaches to be explored. Debt-for-nature swaps are ideally suited to finance Africa’s green transition, as they tackle the twin problems of high debt and negative climate change effects that almost all African countries face today, with hugely indebted Zimbabwe the latest African country considering using them to relieve itself of its hugely constraining debt burden.[9] Besides Zimbabwe, more than half a dozen African countries, including Zambia, Angola, and Kenya are exploring debt-for-nature swaps as well, as more authorities have begun to see them as not only a viable climate financing mechanism, but also a means to cheaply restructure their debt, while pursuing a green agenda in tandem.[10]

Agree on a global carbon price

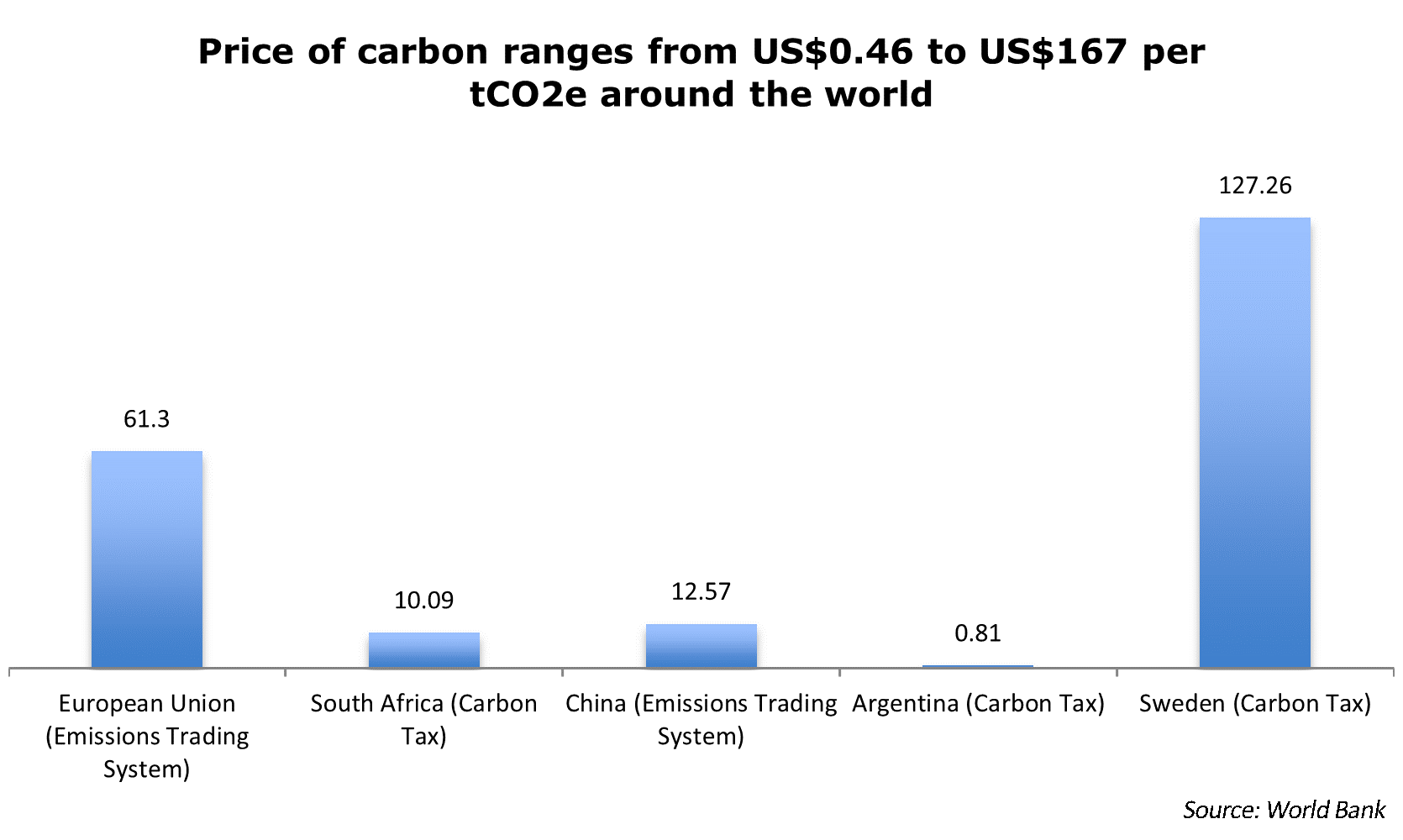

Carbon pricing remains arbitrary, with still limited coverage, and African carbon credits issued thus far are priced way too low, raising arguments increasingly about whether it remains a viable financing mechanism for meeting the Paris Agreement climate action goals. A global consensus on the need for standardised carbon pricing rules has emerged, with the World Trade Organisation (WTO) amongst those leading the charge, being as not having a global carbon price is creating needless trade conflicts, and allowing for the exploitation of poor countries, many in Africa, via arbitrage, as their relatively undervalued carbon offsets, another concerning matter, enables firms to underpay for their emissions.[11] The average carbon price today is US$5 per tonne, with African carbon offsets typically at the lower end of the stick, whereas wealthy Europe is averaging more than US$50 per tonne.[12], [13] In fact the equilibrium carbon price could easily be over US$80 per tonne by 2030, according to the IMF.[14] There are already robust indications that carbon pricing will incentivise climate action over time, but the current arbitrariness needs to be curtailed by global pricing rules, which will ensure low-income countries, especially African ones, get full value for their nature assets.[15] The need for global carbon pricing rules cannot be overemphasized.[16] The African voluntary carbon market is still evolving though, but even as myriad challenges remain, its prospects are undoubtedly bright.[17] The African carbon market’s huge potential is already getting takers regardless, as the renewed interest of the Johannesburg Stock Exchange, the continent’s leading bourse, shows, as though it launched its JSE Ventures Voluntary Carbon Market in 2023 and has seen no issuance of carbon offsets yet, it is optimistic trade will begin from end-2024 onwards, and sees carbon trading as a long-term growth business.[18]

The United Nations has had something of a rethink on carbon credits. It is starting to urge caution after seeing firms buying cheap credit at the expense of more substantive climate action.[19] This may be an error on their part as emission cuts and carbon credits are not mutually exclusive,. In fact, a well-functioning carbon market could be an effective market mechanism for deliver climate financing for low-income countries who are struggling with debt.[20] It will be a huge mistake on the part of African countries to rush ahead into transitioning to green energy as it cannot as yet reliably provide base-load power necessary to support large scale industrialization. A mix of fossil fuels and green energy sources is a necessity for many energy-poor African countries.

Unilateral European trade measures to protect global rainforests, about a third of which are African, reek of colonialism and hypocritical sanctimony, as it totally ignores the negative wealth effects on Africans themselves, whose international trade, which is still quite meagre, will now suffer from even more cost externalities.[21] The European Union’s Carbon Border Adjustment Mechanism (CBAM) is another unilaterally punitive climate action measure that will be punitive for African interests, and further highlights the need for standardised global carbon pricing rules.[22] African countries have raised concerns about the EU’s climate action unilateralism, especially those that affect the continent’s international trade, as they may actually been in violation of WTO rules, some argue.[23]

That said, carbon offsets remain problematic, as they continue to be prone to fraud, which makes it exigent for the verification process to be cleaned up and standardised, and global carbon pricing rules be adopted.[24],[25],[26] There will be an opportunity to do so at COP29, with stakeholders pre-empting the sometimes cumbersome COP negotiation process by adopting a framework ahead of the summit in Baku in mid-November.[27],[28] To deal with the integrity issues, the United Nations is moving quickly to ensure its so-called Paris Agreement Crediting Mechanism is finalised and adopted at COP29, after agreeing how to operationalise it at Pre-COP meetings in Baku in early October 2024.[29]

References

[1] Cotterill, J. (2024, October 14). Expect more emerging market sovereign defaults, says S&P. Financial Times. Retrieved from https://www.ft.com/content/1a625d41-7e1f-415c-beef-2255afa1d498

[2] Martin, E. (2024, October 11). US to seek global financing for cash-strapped developing nations. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-10-11/us-to-unveil-proposal-to-prevent-developing-nation-debt-crises

[3] Campos, R. & Lawder, D. (2024, October 11). IMF to lower member borrowing costs by $1.2 bln annually. Reuters. Retrieved from https://www.reuters.com/business/imf-lower-member-borrowing-costs-by-12-bln-annually-2024-10-11/

[4] Martin, E. & Donnan, S. (2024, February 23). US, China Exploring New Debt Relief Options to Avoid Wave of Emerging-Market Defaults. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-02-22/us-china-exploring-new-debt-relief-options-to-avoid-emerging-market-defaults

[5] Lawder, D. (2024, October 11). US Treasury calls for new IMF, World Bank steps to ease liquidity strains. Reuters. Retrieved from https://www.reuters.com/business/finance/us-treasury-calls-new-imf-world-bank-steps-liquidity-pressures-2024-10-11/

[6] Atlantic Council (2024, October 11). Treasury’s Jay Shambaugh on why the US needs the IMF and World Bank in order to respond to crises. Retrieved from https://www.atlanticcouncil.org/news/transcripts/treasurys-jay-shambaugh-on-why-the-us-needs-the-imf-and-world-bank-in-order-to-respond-to-crises/

[7] Lennon, C. (2024, September 16). Summit of the Future Explainer: Time to accelerate reform of the international financial architecture. UN Affairs. Retrieved from https://news.un.org/en/story/2024/09/1154321

[8] Bloomberg (2024, July 25). China renews call for trillions in climate funds for poor states. Retrieved from https://www.bloomberg.com/news/articles/2024-07-25/china-renews-call-for-trillions-in-climate-funds-for-poor-states

[9] Ndlovu, R. (2024, September 16). Zimbabwe Creditors Mull Debt-for-Climate Swaps to Cure Arrears. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-09-16/zimbabwe-creditors-mull-debt-for-climate-swaps-to-cure-arrears

[10] White, N., Duarte, E. & Sguazzin, A. (2024, October 17). Debt Swaps Created by Credit Suisse Find Favor on Wall Street. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-10-16/debt-swaps-created-by-credit-suisse-find-favor-on-wall-street

[11] The Editorial Board (2024, September 22). The path to global carbon pricin. Financial Times. Retrieved from https://www.ft.com/content/0a4ac951-5b95-4527-82fc-0ec587483ac5

[12] Songwe, V. (2024, September 11). The fragmentation of carbon markets must be fixed. Financial Times. Retrieved from https://www.ft.com/content/70cc3e67-30c8-42b1-8012-51b496816e63

[13] Editorial Board (2024, May 7). To stop climate change, use the power of price. Bloomberg. Retrieved from https://www.bloomberg.com/opinion/articles/2024-05-07/climate-change-carbon-pricing-can-be-incentive-to-reduce-emissions

[14] Black, S., Jaumotte, F. & Ananthakrishnan, P. (2023, November 27). World needs more policy ambition, private funds, and innovation to meet climate goals. IMF Blog. Retrieved from https://www.imf.org/en/Blogs/Articles/2023/11/27/world-needs-more-policy-ambition-private-funds-and-innovation-to-meet-climate-goals

[15] Schwartzkopff, F. (2024, August 5). Goldman Sees Historic Tipping Point Hitting Carbon Market. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-08-05/goldman-sees-carbon-market-heading-for-historic-tipping-point

[16] Bounds, A. (2024, September 16). Global carbon pricing needed to avert trade friction, says WTO chief. Financial Times. Retrieved from https://www.ft.com/content/b2de8c00-a46b-41e3-ba8b-a1e9e0c8b975

[17] Ashraf, N. & Karaki, K. (2024, September 18). African voluntary carbon markets: Boom or bust. ECDPM. Retrieved from https://ecdpm.org/work/african-voluntary-carbon-markets-boom-or-bust

[18] Sguazzin, A. & Prinsloo, L. (2024, August 12). Private Placements, Carbon Seen by JSE as African Growth Route. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-08-12/private-placements-carbon-seen-by-johannesburg-bourse-as-african-growth-route

[19] Bryan, K. (2024, July 23). UN attacks companies’ reliance on carbon credits to hit climate targets. Financial Times. Retrieved from https://www.ft.com/content/0a46a3b0-1672-4763-b5a6-868ae1fd63c5

[20] Moore, M. & Rose, R. (2024, July 23). A cautionary tale from South Africa’s ‘just energy transition’. Financial Times. Retrieved from https://www.ft.com/content/c0e68f17-7b4d-41dc-85c9-cc40f0eda5f1

[21] De Sousa, A. & Ainger, J. (2024, October 3). How Europe’s forest protection drive ran into trouble. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-10-03/how-eu-s-anti-deforestation-regulation-eudr-ran-into-trouble

[22] Beattie, A. (2024, July 29). Small isn’t beautiful when you’re paying EU carbon tariffs. Financial Times. Retrieved from https://www.ft.com/content/c040aea2-d207-49e2-9983-da37464f33f0

[23] Vecchiatto, P. & Monteiro, A. (2024, July 30). South Africa Seeks EU Talks on Carbon Tax It Says Hurts BRICS. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2024-07-30/south-africa-seeks-eu-talks-on-carbon-tax-it-says-hurts-brics

[24] White, N. & Rathi, A. (2024, August 6). Offsets Market Faces Upheaval as Third of All Credits Fail Test. Bloomberg. https://www.bloomberg.com/news/articles/2024-08-06/a-third-of-all-carbon-credits-fail-to-get-key-stamp-of-approval

[25] Pooler, M. (2024, August 4). Brazil minister warns carbon credit buyers to beware fraud. Financial Times. Retrieved from https://www.ft.com/content/ea246444-7bd4-4d1f-8bf0-8adcd3a7eba4

[26] Mundy, S. (2024, August 7). Solving the carbon market ‘integrity crisis’. Financial Times. Retrieved from https://www.ft.com/content/6eb8981e-4117-4aeb-a1b3-40f08ae85f53

[27] Bryan, K. & Mooney, A. (2024, October 11). UN carbon trading expert group agrees deal on market framework. Financial Times. Retrieved from https://www.ft.com/content/7bc234c5-06ad-4ea3-975b-3c05672feeb4

[28] Harris, L. (2024, July 30). Corporate climate targets group steps back from carbon offsets controversy. Financial Times. Retrieved from https://www.ft.com/content/3b6d60e9-524e-4bee-95be-fac8c48c7f9a

[29] United Nations Framework Convention on Climate Change (2024, October 10). Key Standards for UN Carbon Market Finalized Ahead of COP29. Retrieved from https://unfccc.int/news/key-standards-for-un-carbon-market-finalized-ahead-of-cop29

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)