From Danger Zones to Market Darlings

Africa looks set to shine again as Fed cuts interest and China provides stimulus

By Ronak Gopaldas

After a period marked by severe fiscal trauma, Africa's economic prospects are beginning to brighten. A series of external shocks—including the COVID-19 pandemic and subsequent global market disruptions—severely impacted the continent, limiting access to international capital markets and leading to multiple sovereign debt defaults. However, a confluence of recent global developments could provide much-needed relief. With the Federal Reserve embarking on a rate-cutting cycle, China implementing an economic stimulus, and a more favourable global inflationary outlook, there is renewed optimism that African financial markets might finally be on the road to recovery.

Indeed, Africa is starting to see a glimmer of hope after a difficult fiscal period shaped by external pressures that have heavily affected the region’s sovereign outlooks. A key turning point is the US Federal Reserve’s recent move to reduce interest rates, which is expected to make global financing conditions more accessible. This shift is crucial for African economies that have struggled with high debt levels and limited access to international capital markets in recent years. Since 2020, the defaults of Zambia, Ghana and Ethiopia, followed by delays in debt restructuring, have left investors frustrated.

Lower global interest rates could not only decrease the cost of servicing existing debts but also make international borrowing more affordable. This combination of reduced debt burden and improved access to finance represents a much-needed opportunity for recovery and growth.

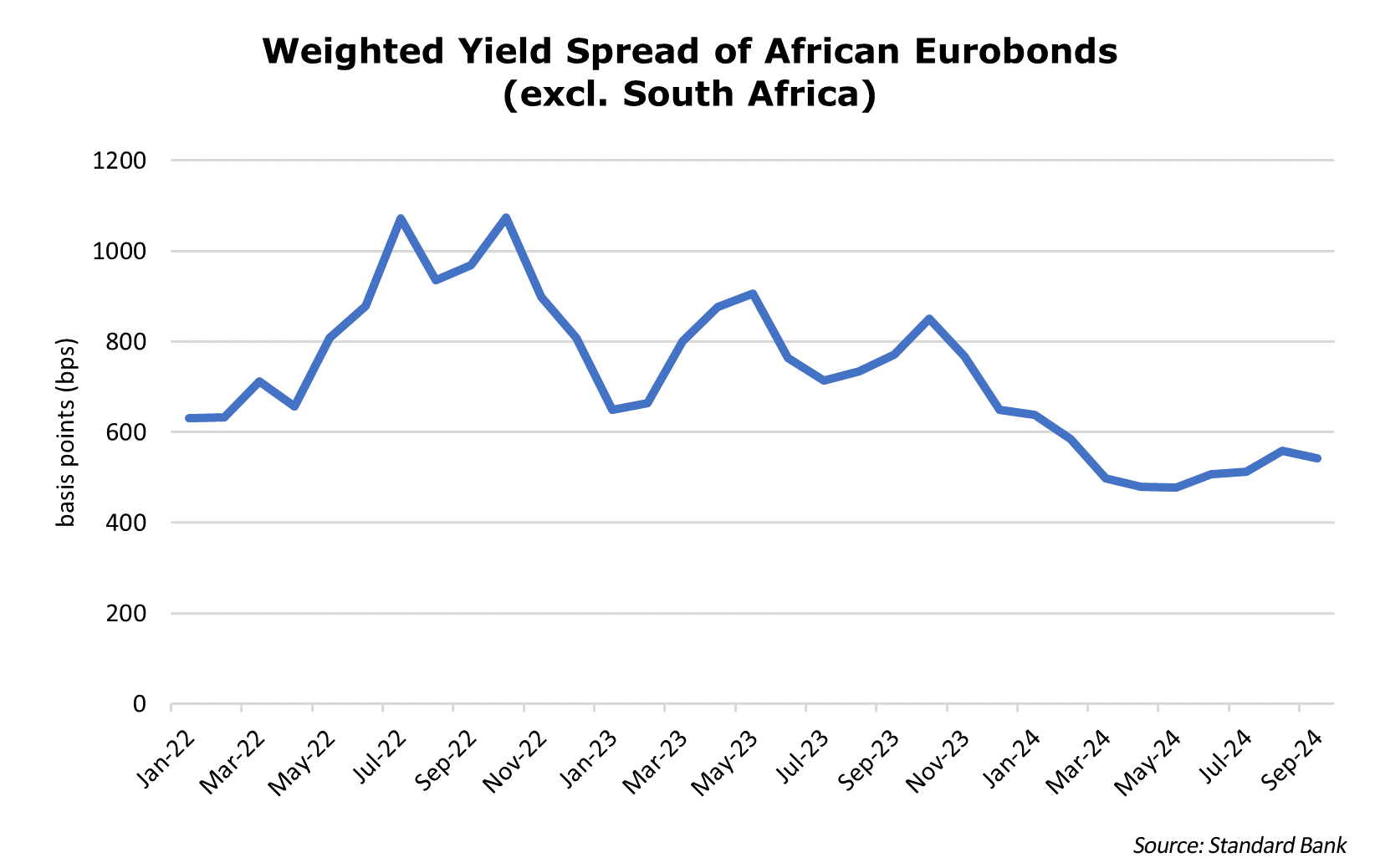

Note: The figure above shows the difference between Africa eurobonds and US bonds. The higher the yield spread, the higher the perceived risk.

Note: The figure above shows the difference between Africa eurobonds and US bonds. The higher the yield spread, the higher the perceived risk.

In tandem with the Fed rate cuts, the recent Chinese stimulus is poised to have a significant impact on Africa—both directly and indirectly. Beyond boosting global sentiment and risk appetite, the stimulus is expected to drive demand for commodities on which many African economies depend. Rising demand for raw materials like copper and iron ore could push up commodity prices, providing African nations with increased revenues and much-needed foreign exchange. This comes on the back of already significant investments in critical minerals such as lithium and cobalt in countries like Zimbabwe and the DRC. Moreover, China's financial commitment to maintaining stability and growth may support African infrastructure projects—a message reinforced at the recent Forum on China-Africa Cooperation (FOCAC) which saw US51bn in fresh funding towards the continent. China remains a crucial trading partner and investor in African nations, particularly in construction, energy, and mining sectors. In this way, the Chinese stimulus could be a catalyst for Africa’s economic recovery, boosting trade and investment channels critical to the continent's growth prospects.

It is not only external dynamics that are lifting the mood. Several political and economic developments across the continent are also driving optimism. Egypt’s economic shock therapy (an IMF programme, currency devaluation and extreme monetary tightening) has attracted investor enthusiasm, as has Zambia's resolution of its debt crisis. Currency devaluations in Nigeria and Ethiopia have also sent the right signals to investors, whilst Kenya managed to avoid default amid severe financing pressures. Senegal’s peaceful elections and the adoption of pragmatic, rather than populist, policies have lifted markets, and have even seen it return to the Eurobond market with a new USD 750m issuance in June. Meanwhile, South Africa’s Government of National Unity has triggered buoyancy in financial markets, with the Johannesburg Stock Exchange continuing to surge and the rand strengthening to multi-year highs. Despite some backlash, countries like Kenya and Nigeria have shown a willingness to make difficult policy choices, albeit with uneven execution. Similar reform momentum can be seen in Angola and Ghana—developments that, coupled with an increasingly supportive external backdrop, are boosting investor confidence.

Despite these positive trends, geopolitical risks remain high, which could undermine the benefits of improved global financial conditions. Renewed tensions in the Middle East represent a critical external shock that could adversely affect African economies. An escalation of conflict in the region could lead to higher oil prices, straining budgets in African nations that rely on energy imports and are already stretched by previous fiscal difficulties. Additionally, investor caution could see a blanket risk premium applied to all emerging market assets in response to rising uncertainties.

Beyond the Middle East, the broader geopolitical landscape is clouded by ongoing tensions between the United States and China, with the risk of their economic and strategic rivalry escalating into open confrontation. Such a scenario could cause significant disruptions to global trade, including reduced Chinese demand or supply chain shocks, both of which would negatively impact African economies. The upcoming U.S. presidential election also adds an element of uncertainty, with potential policy shifts—especially regarding trade—that could exacerbate these tensions and influence investor sentiment towards emerging markets, including Africa.

While optimism is growing, there is a need for caution due to the risk of new reflationary (a resurgence of inflation) shocks and redollarisation (another flight to safety to the US dollar). Reflation could arise from lingering geopolitical uncertainties: first, if the US presidential race affects the Fed cutting cycle, and second, if rising tensions trigger another surge in commodity prices, leading to global inflationary pressures.

African economies, which have only recently begun to see a more favourable inflation outlook, could face renewed price volatility. Furthermore, heightened risk aversion in the face of these shocks could drive investors back to the perceived safety of the US dollar—reversing the benefits of Fed rate cuts and a weaker dollar.

So, where does all this leave African policymakers and investors?

In short, caught between a rock and a hard place. Charlie Robertson, a leading emerging markets economist at FIM Partners, is encouraged by recent developments. However, he points out that the factors driving investor optimism may not resonate with local populations, who are facing the impacts of devaluation, subsidy reforms, and tax increases. This presents a significant challenge for policymakers across the continent—to strike a delicate balance between market interests (prudent financial management) and socio-economic stability. Miscalculating this balance, as seen in countries like Kenya and Nigeria, can have serious consequences.

Although financial markets are becoming more optimistic about Africa's prospects, yield hungry investors must remain mindful of the risks and be prepared for potential disruptions to financing conditions and market access across the continent. Success will require careful diversification and agility in the face of volatile geopolitical dynamics. While opportunities are emerging and there are compelling reasons for cheer, the road to recovery is still fraught with uncertainty.

References

The East African. “Ethiopia Third Africa State to Default on Sovereign Debt,” available at: https://www.theeastafrican.co.ke/tea/business/ethiopia-third-africa-state-to-default-on-sovereign-debt-4474758 (Accessed: 02 October 2024).

Russell Investments. “Fed Rate-Cutting Cycle Begins,” available at: https://russellinvestments.com/uk/blog/fed-rate-cutting-cycle-begins (Accessed: 03 October 2024).

The Conversation. “China's Interests in Africa Are Being Shaped by the Race for Renewable Energy,” available at: https://theconversation.com/chinas-interests-in-africa-are-being-shaped-by-the-race-for-renewable-energy-237679 (Accessed: 03 October 2024).

Reuters. “China to Deepen Industrial Agricultural Trade Investment Ties with Africa,” available at: https://www.reuters.com/world/china-deepen-industrial-agricultural-trade-investment-ties-with-africa-2024-09-05/ (Accessed: 03 October 2024).

Reuters. “Egypt Raises Interest Rates by 600 BPS; Pound Tumbles,” available at: https://www.reuters.com/world/middle-east/egypt-raises-interest-rates-by-600-bps-pound-tumbles-2024-03-06/ (Accessed: 03 October 2024).

Financial Times. “Africa's Economic Recovery in Sight,” available at: https://www.ft.com/content/1729aa7c-3f92-4ff7-9310-c79b5e5cdb84 (Accessed: 04 October 2024).

Reuters. “Ethiopia Shifts to Market-Based Foreign Exchange System,” available at: https://www.reuters.com/markets/currencies/ethiopia-shifts-market-based-foreign-exchange-system-2024-07-29/ (Accessed: 06 October 2024).

Bloomberg. “Senegal’s Bonds Sink as Investors Weigh Opposition’s Electoral Momentum,” available at: https://www.bloomberg.com/news/articles/2024-03-25/senegal-s-bonds-sink-as-investors-weigh-opposition-s-electoral-momentum (Accessed: 03 October 2024).

Frontier Markets. “The Tide is Turning in Africa,” available at: https://frontiermarkets.co/the-tide-is-turning-in-africa (Accessed: 03 October 2024).

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)