Is it time to turn bullish on South Africa?

Coalition government ushers in new hope, but worries remain

By Ronak Gopaldas

Photo source: Xinhua/Zhang Yudong

Photo source: Xinhua/Zhang Yudong

As South Africa begins a new era of coalition politics nationally, investors are closely watching for signs that it is finally time to get excited about the country after almost two decades of economic underperformance. A recent return to the country revealed mixed views and a dichotomy between offshore and onshore investor sentiment. While there is a sense of optimism among international investors who are betting on reform and are consequently positive about the country’s political and economic trajectory, locals generally remain more sceptical. They worry about increased dysfunctionality and policy inertia and want to see clear evidence of progress before becoming enthusiastic.

So which view is more likely to prevail? As is always the case in South Africa, nothing is ever straightforward, and there are many competing agendas and complex tensions that threaten to derail progress. It is often a case of one step forward and two steps back. However, the direction of travel is broadly positive and investors would do well to remain alert to the opportunities that are likely to emerge.

Financial Markets

The first ground for optimism is financial markets. After nearly a decade during which portfolio investors dumped South African assets the tide is turning. This shift is driven by the attractive valuations of South African FX, bonds, and equities. Early evidence shows how the market rallied significantly on the back of the initial deal that brought the ANC and DA together. The JSE’s banking index has risen by 19% since the announcement. On a relative basis, South African interest rates and bond yields represent a favourable carry trade, which has piqued investor interest. As a small open economy, South Africa will always remain vulnerable to global developments; however, reform momentum, political stability, and current valuations make a compelling case for significant funds to flow in.

Policy Coordination

The second reason for optimism is policy coordination. In a world where the independence of central banking is increasingly being contested by politicians, the South African Reserve Bank has resisted populist pressure and has maintained a strict adherence to inflation targeting. In a continent where runaway inflation is the norm (inflation is running at over 30% in Nigeria and 40% in Ghana) and where cost-of-living pressures are already significant, this is no small feat. Inflation currently sits at a respectable rate. The renewal of the terms of two deputy governors is also a signal of broad policy continuity within a key economic institution and will give investors comfort. Moreover, there is broad alignment with fiscal policy, which has seen significant improvements. The country has recorded a primary budget surplus for the first time since the Mbeki era and has displayed the largest year-to-date improvement among emerging markets.

With the Treasury now proposing a fiscal rule, policy alignment with continued orthodox monetary policy makes South Africa attractive in a world competing for discretionary capital.

Economic Growth Engines

Thirdly, on the supply side of the economy, the key engines of economic growth are being repaired after being gutted under the Zuma administration. Under the 2020 Operation Vulindlela, reforms aimed at reviving utilities and telecommunication have finally started to take off. For the first time in a long time South Africa recorded three straight months free of power cuts, or ‘load shedding’ as it has euphemistically been called. Although progress has been slow, the improvement of electricity supply is certainly visible. The decision to allow private electricity generation in 2021 has had a catalytic effect on investment and will provide a major tailwind for growth and revenue. Energy experts suggest that power supply issues could be a thing of the past by 2025, while economists estimate that a stable electricity supply could add up to two percentage points to growth. Meanwhile, in logistics, container and shipping backlogs have been cleared at the key Cape Town, Durban, and Richards Bay ports since the first quarter of 2024. Steps towards the unbundling and/or partial privatisation of parastatals have also been initiated. This means the new cabinet will start on a decent footing with some momentum, aided by the retention of key individuals in strategic ministries. Overlaid with greater trust and local private sector involvement, it is clear the dividends of such endeavours are yet to be fully realised.

Foreign Direct Investment

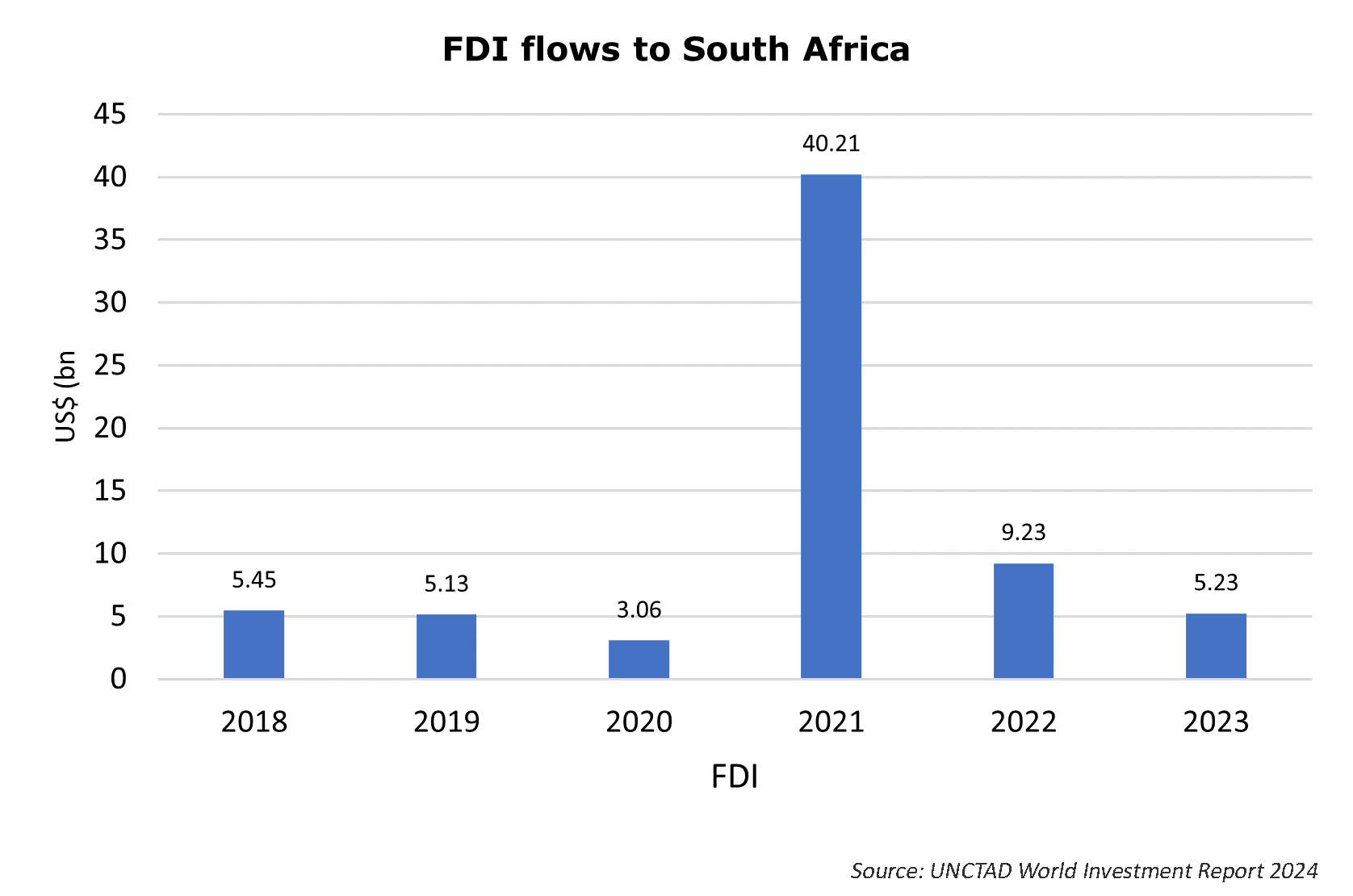

Fourthly, major multinationals continue to place big bets on the country. South Africa continues to receive an outsized proportion of the FDI in Southern Africa. Companies like Heineken, PepsiCo, Amazon, and Microsoft have all undertaken significant investments. Foreign direct investment has remained strong, and greater reform momentum will further boost growth and create jobs. In 2021, South Africa received over US$40.2bn in FDI. Although this was in large part due to an exceptional M&A deal, South Africa has received US$5bn in FDI every year since 2018 on average. The recent election, coupled with potentially lower interest rates may provide the impetus for local companies, who have effectively been on an investment strike, to invest their reserves. South Africa’s importance as the gateway to Africa , its rising middle power status, and its pursuit of multilateralism (and ability to engage in multiple international fora in a geopolitically tense environment) will also boost its global standing, as will its hosting of the G20 Summit in 2025.

Resilience

Fifthly, an intangible and somewhat unquantifiable factor is South Africa’s innate ability to go to the brink and pull back. The elections have shown that democracy in South Africa works. Despite the slow pace there is accountability, and reforms are happening gradually. The benefits of these actions have yet to be fully realised, but there is clear momentum in the right direction.

Risks and Concerns

Of course, it is not all sunshine and roses, and there are risks that continue to worry investors. Memories of the 2021 riots in KZN and the strong showing of the MK party have raised fears that violent disruptions may again occur. Then there is the political cycle, with local government elections in 2026 and the ANC elective conference in 2027. After being replaced as ANC Presidents in 2007 and 2017 respectively, both Thabo Mbeki and Jacob Zuma were removed from the national presidency soon thereafter. Given this precedent of not having two centres of power and the lack of a credible successor, will Ramaphosa suffer the same fate, and what would it mean for the stability of the Government of National Unity (GNU)? There is also the question of whether a grand coalition government can actually work, given the historical enmity between the African National Congress (ANC) and the Democratic Alliance (DA), the track record in coalition governments at a local level, and the ANC’s embedded patronage networks. Policy disagreements, such as the National Health Insurance scheme, will also need to be resolved, and the coalition's stability will be tested. The GNU creates the prospect of better accountability but also risks policy paralysis as decision-making is more onerous. Failure to achieve policy coherence and deliver growth could create fertile conditions for populist alternatives to thrive.

These are all legitimate concerns and worth watching closely. However, when assessing the scorecard, the evidence suggests more positives than negatives, and the key actors in the new GNU have a vested interest in growing the economy.

Local sentiment

Why, then, are South African investors so unconvinced? For one, they are jaded. Perhaps it is the deeply emotional and hyperbolic nature of the country, where discourse swings from Ramaphoria to Ramageddon in a matter of months, and where narratives around a failed state are replaced with adoration of the country’s democratic maturity. This schizophrenia is amplified by a noisy media, which thrives on negative news and is often lacking in nuance.

South Africans tend to experience dysfunction in a way that international investors can only grasp on a conceptual rather than practical level. With the government’s poor track record of service delivery and the evident decay of key infrastructure, South Africans have learned to keep expectations low.

But there is another reason too. To a large extent, South African investors remain unconvinced simply because they see better opportunities elsewhere. According to some portfolio managers, even in a rosy scenario for SA, it remains relatively low growth and investment opportunities are quite narrow. And with the increasing deregulation and relaxing of capital controls, SA investors are no longer bound to invest in the SA economy or the JSE. Simply put, the ‘pull factors’ of other markets and companies is currently more attractive.

Outlook

These are perfectly understandable reasons, but investors need to be careful not to miss the wood for the trees. The new formation may breed healthy competition, and if the politicians exercise a level of maturity, it is not difficult to see the economy finally turning the corner.

If the government can maintain its reform momentum and navigate the complexities of coalition politics effectively, South Africa could very well be on the cusp of an economic turnaround – although gains will be slow and steady rather than big bang. The next few years will be critical in determining whether the country can leverage its potential and translate optimism into tangible growth and jobs.

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)