Is the digital stack of India a model for Africa?

A technological architecture that has accelerated financial inclusion in India looks ready for adoption

By Ronak Gopaldas

India’s digital stack is often heralded as a milestone developmental innovation of this century. In transforming identification, financial inclusion and service delivery through low cost, scalable and interoperable digital infrastructure, and leveraging public-private partnerships, it has accelerated India’s key productivity and welfare metrics. Faced with similar developmental challenges, the stack has caught the attention of African policymakers and businesses. Many would like to adopt this technology for their own development. Accordingly, it is worth examining the stack, its impact in India, commercial opportunities in Africa and adaptations by local and foreign stakeholders.

The stack explained

The India Stack refers to digital public infrastructure and platforms owned and maintained by different agencies.[1] It facilitates large-scale, multifunctional and interoperable digital services for the state, businesses and households in a seamless and secure manner. Although built by the government, the open architecture of the stack allows anyone to operate and build commercial applications on it. Initially intended for identification purposes, the stack has since been used for functions such as personal transactions, government transfers, health services, insurance and even education.[2]

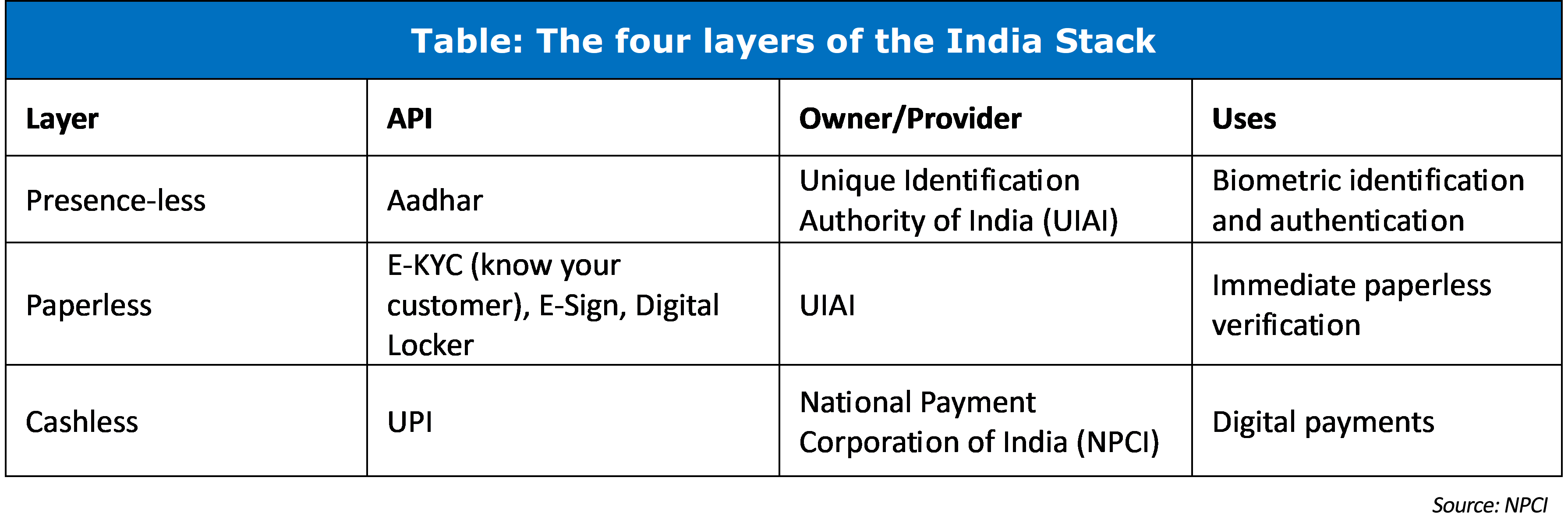

The stack is built upon four technology ‘layers’ - a presence-less layer, followed by a paperless layer, a cashless layer and a consent layer.[3]

Presence-less Layer

Presence-less Layer

The presence-less layer – which is the foundation of the stack – is anchored on the Aadhaar biometric digital identity system. Established in 2010 by the Unique Identification Authority of India (UIAI), Aadhaar provides individuals with a unique 12-digit identification number backed by biometric details.[4] It allows them to make digital cash transactions, access public service, receive social benefits or engage with government agencies without necessarily being physically ‘present’. As many as 1.4 billion Indians are enrolled under Aadhaar, according to the UIAI, suggesting near universal coverage.[5]

Paperless-less Layer

Atop the presence-less layer is the paperless layer. This links digital records and associated functions to Aadhaar identities in order to limit excessive bureaucracy and paperwork. It has three components – e-KYC, E-Sign and Digital Locker facilities.[6] E-KYC – short for ‘know your customer’ – allows for authentication of individuals via the Aadhar system; E-Sign enables digital signatures anywhere on compatible devices; and Digital Locker serves as a vault for digital storage of documents.

Cashless Layer

A cashless layer sits atop the paperless layer. It was introduced in various iterations to allow for seamless transactions and consists of an interoperable payment network with four products. At the centre is the so-called United Payment Interface (UPI).

Consent Layer

The consent layer binds the stack together ensuring its functionality and imbuing trust in the system. Central to this is the Data Empowerment and Protection Architecture (DEPA) which is overseen by the Reserve Bank of India (RBI) and the NPCI. This consists of mechanisms allowing individuals to assent to the exchange of personal data between different agencies and providers through fiduciaries.

The Power of Identity

Acquiring a veritable identity is hardly a consideration in developed societies, where such processes are readily and universally available. However, for the 850 million that lack formal identification, it arguably is an existential concern. Without formal identification, individuals are invisible to the system and lack the basis for most social engagements, transactions and entitlements. This denies them basic services such as education, health, schooling and housing, and restricts opportunities for employment. Nandan Nilekani – the techpreneur who first conceived the idea of Aadhar predicted that a ‘veritable identification would be transformative for India’s poorest. In identifying people the government would create scope for social mobility, it would also be compelled improve public services.[7] His vision has now become something of a reality.

The Aadhaar

The stack has transformed public administration, financial inclusion and doing business in India. Aadhaar is the world’s largest biometric personal identification system. It is a simple 12-digit identification number that serves as proof of identity and address for a resident of India and has become a bedrock of India’s digital economy and an exemplary model of efficient and cost-effective channel of public service delivery. The introduction of Aadhaar has helped reduce leakages and malpractice in the transfer of cash and other welfare schemes. According to the World Bank, the Government of India may be saving more than US$1bn per year by eliminating ‘ghost’ beneficiaries and corruption in the public distribution system.[8]

The coronavirus pandemic demonstrated the utility of the stack beyond identification and finance. In 2021 the Ministry of Health and the NIC pioneered the Covid Vaccine Intelligence Network (COWIN), on the back of Aadhaar. It allowed for arguably the most efficient mass vaccination initiative across the world during the pandemic, through speedy registration, dose tracking and post vaccination monitoring as many as 1.3 billion doses were delivered in less than a year – the fastest of any country.[9]

Similarly, in the financial sector, the Aadhar allowed the Pradhan Mantri Jan-Dhan Yojana (PMJDY)- a universal banking initiative – to open 500 million new bank accounts since its inception in 2014. A significant proportion of beneficiaries are rural individuals and businesses beyond the orbit of traditional banking structures. This is largely enabled by its authorisation of zero balance accounts – an unusual concession in conventional banking practice but one which has significant payoffs for India.[10]

Universal Payments Interface

UPI interlinks the Aadhaar system, bank accounts and digital wallets through a virtual payment address (VPA). Users can then use the VPA to transact with banked and non-banked entities, provided they at least have a digital wallet. A zero charge is applied to consumers while merchants are charged a small interchange fee.[11]

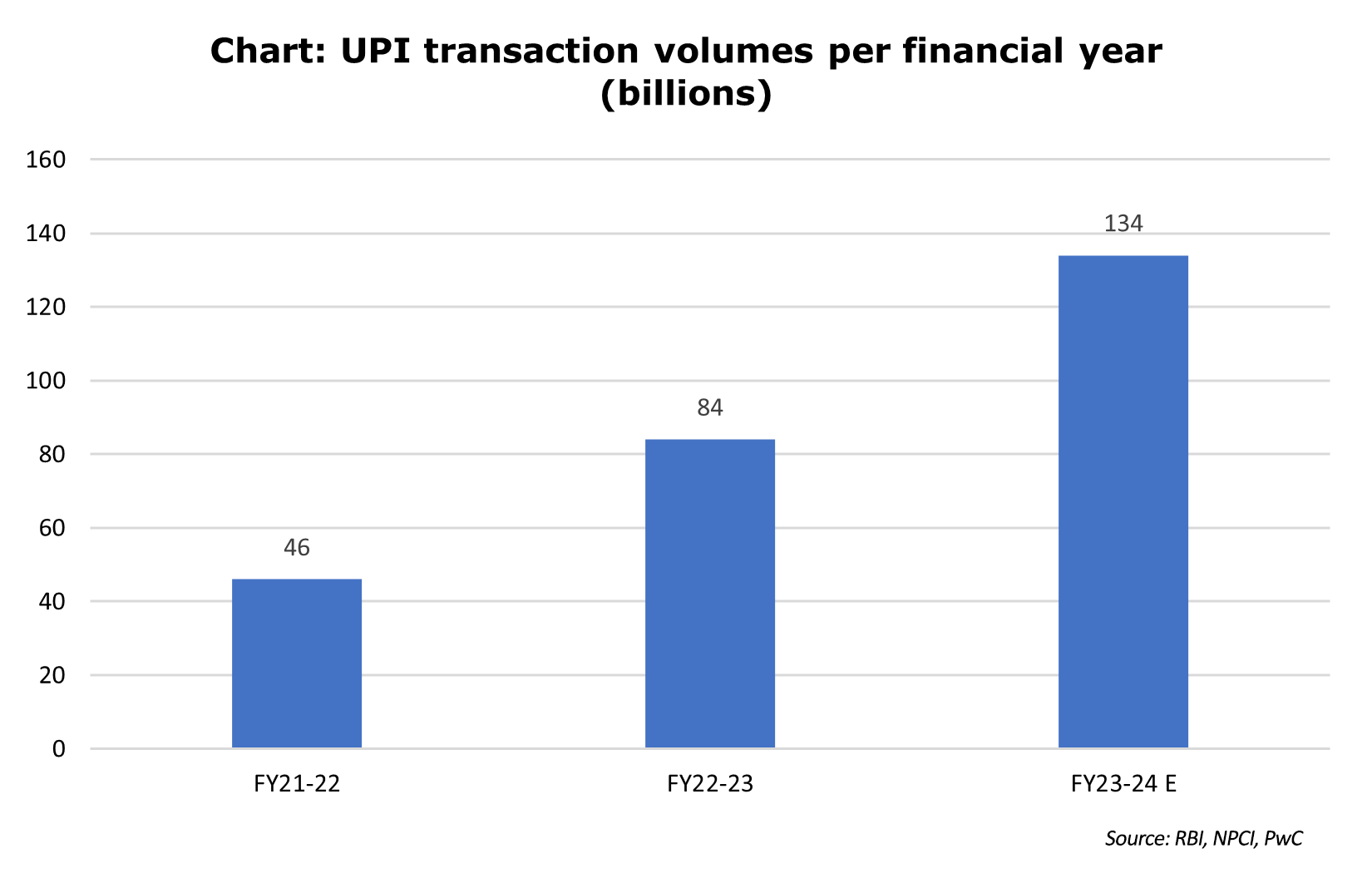

UPI has seen exponential growth in the volume of transactions. Beginning at about 100,000 transactions per month in 2016, the payments interface registered 15 billion payments in August 2024; collectively amounting to more than US$240bn.[12] It has also emerged as a leading mode of payment among businesses, accounting for nearly 75% of retail transactions in 2023. Its mobile first, QR enabled, integrated and low-cost nature has made it a favourite among small medium and micro enterprises. Equally, the financial trail acquired through UPI has simplified business profiling and risk quantification for lenders. As a result, more accurate credit scores can be speedily assigned and loans better tailored for inviduals and businesses.

On the macro level, the stack is central to rapid improvements in India’s business environment. According to the discontinued Doing Business Report by the World Bank, India’s ranking rose from 142nd in 2014 to 63rd in 2019. Central to this was the development of the stack and its role in simplifying, diversifying and upscaling the volume of business in the country.[13] A 2019 report by McKinsey estimated that the stack could contribute as much as USD 1 trillion to GDP by 2025, generating nearly USD 150 billion in revenue.[14]

On the macro level, the stack is central to rapid improvements in India’s business environment. According to the discontinued Doing Business Report by the World Bank, India’s ranking rose from 142nd in 2014 to 63rd in 2019. Central to this was the development of the stack and its role in simplifying, diversifying and upscaling the volume of business in the country.[13] A 2019 report by McKinsey estimated that the stack could contribute as much as USD 1 trillion to GDP by 2025, generating nearly USD 150 billion in revenue.[14]

Employment and other welfare markers have also been improved by the stack. Government data suggests that formalisation of informal businesses has helped create more than 68 million new jobs in 2023. The BCG group estimates that the so-called gig economy, anchored on the stack, will employ and additional 90 million people by 2030. Elsewhere, the government’s Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) digital literacy initiative has trained close to 50 million people in rural areas, rendering them employable in lucrative tech postings.[15]

The relevance of Aadhar for Africa

Africa’s array of challenges, present myriad commercial opportunities for Indian stakeholders already involved in the stack.

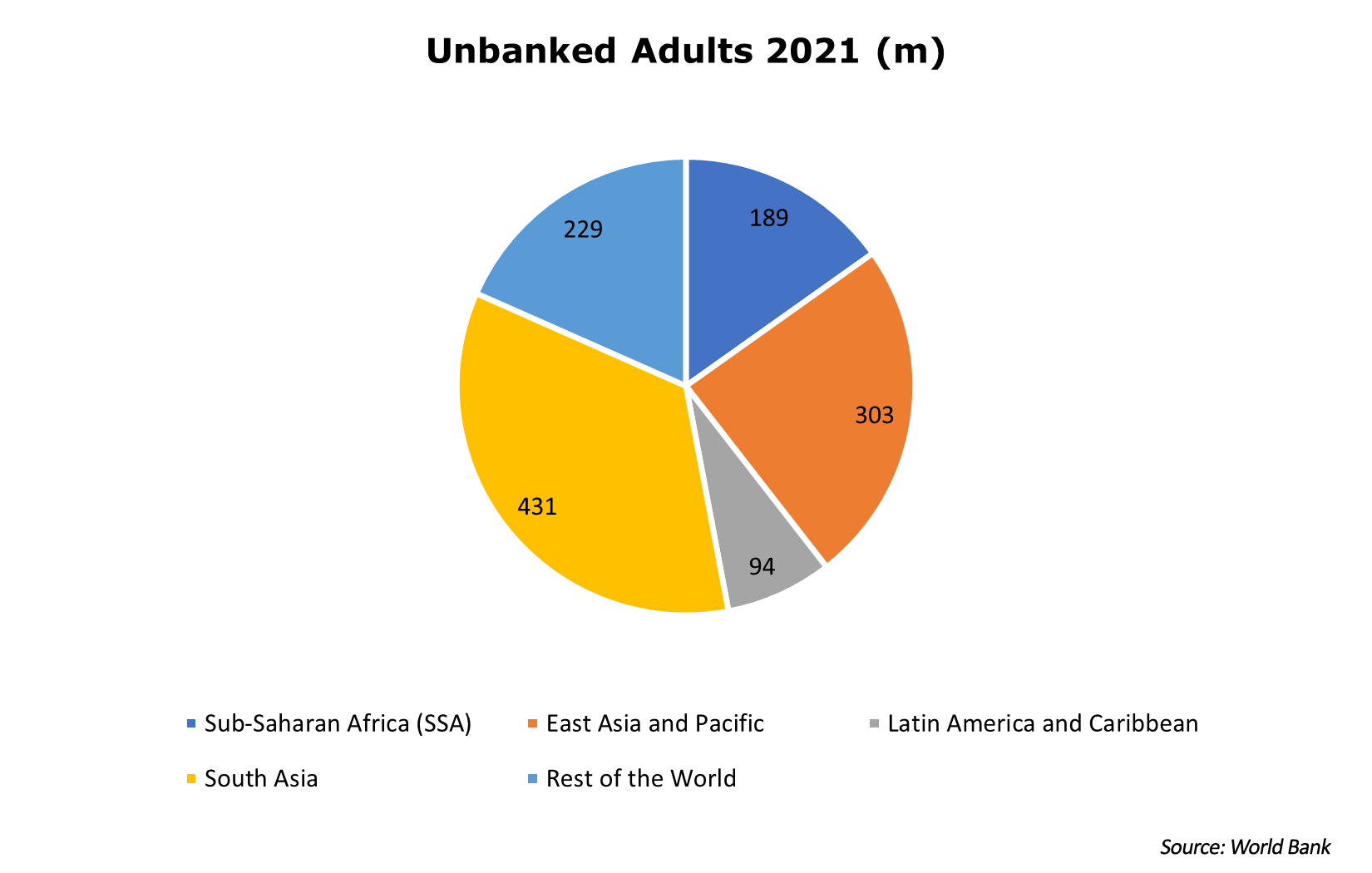

According to the World Bank, of the more than 850 million people that lack formal identification; 500 million are in Africa.[16] Such a challenge presents an opportunity for a digital identity system like Aadhaar. Aadhaar’s success in India demonstrates how digital identity systems can transform public administration by improving transparency, reducing fraud, and enhancing service delivery, whilst serving as a bedrock for a network of digital infrastructure. In Africa, a similar digital identity framework could significantly address the ghost worker problem, saving billions in public funds. Moreover, it would enable governments to better track and reach vulnerable populations, strengthening public health initiatives. This would lay the foundation for more efficient governance, service delivery, digitization and sustainable development across the continent.

Banking the Unbanked

Financial inclusion remains a significant challenge in Africa. Only 49% of the continent’s adult population is formally banked. This has undermined credit growth and consumption activity across the market. A trust deficit between small businesses and banks – mostly due to information asymmetry – also constrains financing opportunities, leading to the pricing of micro loans at a relative premium. As a consequence, small businesses across the continent are going without adequate financing contributing to the funding crisis faced by scaling businesses, at the expense of growth and employment.[17]

A system like UPI and its anodes – embedded in mobile platforms – could be useful in this context, especially given the degree of mobile penetration across the continent. This could fast track financial inclusion by providing a universal, low-cost payment platform that leverages the continent's high mobile availability. UPI’s ability to facilitate seamless, real-time digital transactions between individuals, businesses, and banks would reduce reliance on cash, foster greater trust between small businesses and financial institutions, and lower the cost of microloans. By addressing information asymmetry, such a system would unlock access to affordable credit for millions of underserved businesses. Closing this financing gap would stimulate much needed bottom-up economic growth.

Closing the funding gap:

Closing the funding gap:

Furthermore, in as much as there is intent to develop and adopt innovative technologies, large scale funding and capacity remain key constraints. According to the Venture Capital in Africa Report, US$3.6bn in deals was concluded in 2023. This is a fraction of the US$285bn deals concluded across the world. Innovation is underfunded in Africa; most governments are overstretched and have little headroom to accommodate greater expenditure. As was the case in India, this can be bridged through private-public partnerships, where states facilitate the digital ecosystem, and the private sector implements and scales solutions.

Pitfalls of the stack

The stack does have its pitfalls, which limits its adaptation in an African context and in some instances raises concern over a variety of risks. For one it seems to require the leadership of a big well-endowed government with long term strategic planning and trust among the people. Centralised control over identification – through Aadhaar – is at the heart of stack, while the state and its organs have their fingers in base infrastructure such as UPI. Interoperability is also enforced by central bank decree.

Most African countries do not have the political capacity to steer such a process. Many lack the financial, manpower and technical resources to roll out such a system at scale. Those that have the resources may lack public trust that can compromise their ability to undertake such an initiative.

As David Medine of the Consultative Group to Assist the Poor (CGAP) writes, databases belying the stack offer governments a tool for tracking and surveilling citizens.[18] Whilst there are consent-based protections for such data in India, the government can access it for national security purposes. In an African context where national security is often used a pretext for overreach – and where checks on governments are weak – it easy to see how such data can be exploited.

Cybersecurity is also a concern with adaptations of the stack. According to the Global Threat Index, Africa has the weakest cyber-security infrastructure and legislature. This so-called cybersecurity deficit renders the continent particularly vulnerable to attacks, with government and businesses institutions equally exposed. In July 2023, Kenya – one of the most digitized and cyber secure countries on the continent – suffered a major attack that disrupted government and commercial services such as the M-Pesa payment platform. Further digitization amid a cybersecurity deficit may only court similar such attacks.

Betting on the stack

Despite prevailing risks, African stakeholders have seized the opportunity. There are at least eight major tech initiatives across the continent that have borrowed elements of India’s digital innovations in various ways.

In 2019 Kenya rolled out its own Aadhar-like initiative called the National Integrated Identity Management System (NIIMS) or Huduma Namba. Like the Indian digital identity system, Huduma Namba would assign every Kenyan a unique identification number linked to their biometric and personal data. It would also integrate with existing government databases, including tax, health insurance, pension, and voting. By 2021, 11 million Kenyans had registered for Huduma Namba; however, it was discontinued that year following a High Court ruling stating that the initiative was in contravention of Kenya’s data protection act.[19] In June 2023 President William Ruto assured that his government was in the process of resurrecting Huduma Namba, taking into consideration the shortcomings detailed by the High Court.

Adaptation of payments technology akin to UPI has been far more widespread and affective. Kenya’s renowned M-Pesa mobile payments initiative predates UPI by nine years; however, M-Pesa’s owners and banking interests have learned and adapted key lessons from the Indian initiative. Inspired by UPI, the Central Bank of Kenya is advocating for greater interoperability between mobile money platforms. Kenya’s neighbour, Tanzania launched in 2022 the so-called Tanzania Instant Payment System (TIPS). Like its Indian cognate, TIPS is centred on facilitating interoperable transactions across banks and mobile money platforms in order to promote financial inclusions and boost economic activity. In 2023 it processed 234 million transactions valued at more than US$ 4.5bn. By end-2023 it had already onboarded 45 financial service providers, demonstrating its appeal and growth potential.[20]

Rwanda also has infrastructure more akin to a full stack. The country’s Irembo initiative combines of elements UPI and DigiLocker mostly in the realm of public services. A cornerstone of Rwanda’s e-government strategy, Irembo allows citizens to access over 100 government services online, including birth registration, driving licenses, land registration, marriage certificates, and more. Its linkages with with mobile money platforms such as MTN Mobile Money and Airtel Money – by India’s Bhati Airtel –allows payment for services on handheld devices. It has been lauded for optimising public services whilst reducing public sector leakages and corruption, Moreover, it is emerging into the nerve centre of Rwanda’s efficient public service and business environment.[21]

The stack has also found utility in Africa’s multinational domain such Africa’s smart city initiative. Adopted by seven countries thus far, the initiative aims to collectively address urbanisation, welfare and infrastructure challenges through technology and urban planning. It fronts digital identity and payment systems akin to Aadhaar and UPI.[22]

Geopolitically, the stack is emerging as a vector of India’s soft power in Africa. It may even be seen as New Delhi’s the answer to China’s Belt and Road Initiative (BRI) in the continent. Prime Minister Narendra Modi has alluded to establishing India as the Vishwa Guru or world teacher, with its digital advantage being the primary doctrine.[23] India, unlike technological peers such as the United States, China and Japan is well poised to pioneering such innovation in Africa. Not only does it have an early movers advantage in developing the stack but it has comparable socioeconomic challenges to Africa. In departing from similar dispositions, this makes Indian technologies a better fit, or at least more readily adaptable. Through economies of scale and years of innovation and refinement, India has rendered such digital infrastructure as cost effective. Furthermore, Indian partnerships are not met with similar public scepticism to those with Chinese interests.

Africa – which Modi has described as a ‘top priority’ for India – has been receptive. In 2023, at least 10 countries were in talks with India for assistance in developing analogous identification, payments and health technologies.[24] DigiLocker has even been put forward as a solution to data storage and transfer challenges associated with the African Continental Free Trade Area (AfCFTA). This could assist in speeding up the operationalisation and effectiveness of the landmark initiative.

Along with the state, India’s private sector has also played a key role in advancing analogous technologies in Africa. Tech Mahindra has invested in establishing digital solutions for the banking and telecommunications sectors in the continent. In Ghana it is part of a joint venture planning to invest up to US$ 145bn in a shared 4G/5G platform accessible to all operators. According to Ghana’s communications minister, Ursula Owusu-Ekuful, “we are inspired by India's digital infrastructure and low-cost mobile data usage and keen to replicate it in Ghana."[25] Elsewhere, Bhati Airtel is at the centre of Tanzania’s TIPS initiative with its Airtel Money offering. Plans are in place to expand Airtel’s zero fee transfers and remittances to markets including Ghana, Malawi, Nigeria, Kenya and Zambia through a venture with Zimbabwe’s Cassava Technologies.[26]

Conclusion

The future of growth is digital. In an increasingly digitized world, where innovation, integration, efficiency, and policy soundness are disproportionately rewarded, countries that embrace such strategies are likely to leapfrog the developmental path. Conversely, countries with limited digital and disaggregated digital infrastructure, and policy opacity may lag behind – thus widening developmental divide. Adopting the stack could drive widespread digital transformation in Africa, fostering economic growth, improving governance, and reducing inequality. However, it will require significant investment in digital infrastructure, regulatory reforms – some US$108 bn according to the African Development Bank – and a commitment to inclusivity to ensure that the benefits are maximised and shared.[27]

References

[1] IndiaStack.org. "Frequently Asked Questions." Accessed October 9, 2024. https://indiastack.org/faq.html.

[2] Morse, Andrew. "What Happens When a Billion Identities Are Digitized?" Yale Insights. Yale School of Management, May 23, 2019. https://insights.som.yale.edu/insights/what-happens-when-billion-identities-are-digitized.

[3] Emeritus. "What Is the India Stack? How Is It Driving Innovation in Our Industries?" Accessed October 9, 2024. https://emeritus.org/in/learn/what-is-the-india-stack-how-is-it-driving-innovation-in-our-industries/.

[4] Nisar, Arvind. "Experience with India Stack: Open Lecture." University of Luxembourg, August 2024. https://www.uni.lu/wp-content/uploads/sites/3/2024/08/Nisar_Experience-with-India-stack_open-lecture.pdf.

[5] Unique Identification Authority of India (UIDAI). "Aadhaar Dashboard." Accessed October 9, 2024. https://uidai.gov.in/aadhaar_dashboard/india.php.

[6] Gelb, Alan, and Julia Clark. Public Sector Savings and Revenue from Identification Systems: Opportunities and Constraints. Washington, DC: World Bank, 2018. https://documents1.worldbank.org/curated/en/745871522848339938/Public-Sector-Savings-and-Revenue-from-Identification-Systems-Opportunities-and-Constraints.pdf.

[7] McKinsey & Company. For every citizen, an identity: Leveraging digital ID in emerging economies. Accessed November 14,2024 https://www.mckinsey.com/~/media/McKinsey/Industries/Public%20Sector/Our%20Insights/For%20every%20citizen%20an%20identity/9%20ForEveryCitizen.pdf

[8] Gelb, Alan, and Julia Clark. Public Sector Savings and Revenue from Identification Systems: Opportunities and Constraints. Washington, DC: World Bank, 2018. https://documents1.worldbank.org/curated/en/745871522848339938/Public-Sector-Savings-and-Revenue-from-Identification-Systems-Opportunities-and-Constraints.pdf.

[9] Exemplars. “COWIN IN INDIA: THE BACKBONE FOR THE COVID-19 VACCINATION PROGRAMME. Accessed 11 November, 2024. https://www.exemplars.health/emerging-topics/epidemic-preparedness-and-response/digital-health-tools/cowin-in-india

[10] Pradhan Mantri Jan-Dhan Yojana (PMJDY). "Account Statistics." Accessed October 9, 2024. https://pmjdy.gov.in/account.

[11] HDFC Bank. "Is There Any UPI Transaction Charges?" Accessed November 14, 2024. https://www.hdfcbank.com/personal/resources/learning-centre/pay/is-there-any-upi-transaction-charges.

[12] National Payments Corporation of India (NPCI). "UPI Product Statistics." Accessed October 9, 2024. https://www.npci.org.in/what-we-do/upi/product-statistics.

[13] Press Information Bureau, Government of India. "Press Release PRID 2003540." September 2024. https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2003540.

[14] McKinsey. “Digital India, Technology to transform a connected nation”. Accessed 10 November, 2024. https://www.mckinsey.com/~/media/mckinsey/

[15] Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA). "About PMGDISHA." Accessed October 9, 2024. https://www.pmgdisha.in/about-pmgdisha/.

[16] Ansar, Saniya, and Julia Clark. "The Importance of ID Access in Three Charts: Insights from Sub-Saharan Africa." World Bank Blogs, September 9, 2024. https://blogs.worldbank.org/en/digital-development/the-importance-of-id-access-in-three-charts--insights-from-sub-s.

[17] Africa.com. "Challenges to Business Lending in Africa and How DeFi Can Help." Accessed October 9, 2024. https://www.africa.com/challenges-to-business-lending-in-africa-and-how-defi-can-help/.

[18] CGAP. "India Stack: Major Potential in Mind, Risks Ahead." Accessed 16 October https://www.cgap.org/blog/india-stack-major-potential-mind-risks.

[19] ITWeb Africa. "Kenya to Launch New Digital ID." Accessed October 9, 2024. https://itweb.africa/content/KA3Ww7dzZ25qrydZ.

[20] IremboGov. "Irembo: Official E-Government Services." Accessed October 9, 2024. https://irembo.gov.rw/.

[21] Tanzania Invest. "Digital Payments and Mobile Money Report 2023." Accessed October 9, 2024. https://www.tanzaniainvest.com/finance/banking/digital-payments-mobile-money-report-2023.

[22] African Smart Cities. "African Smart Cities." Accessed October 9, 2024. https://africansmartcities.info/.

[23] The Economist. "How India Is Using Digital Technology to Project Power." June 4, 2023. https://www.economist.com/asia/2023/06/04/how-india-is-using-digital-technology-to-project-power.

[24] Bloomberg. "India Discussing Sharing Its Technology with African Nations." January 25, 2023. https://www.bloomberg.com/news/articles/2023-01-25/india-discussing-sharing-its-technology-with-african-nations?embedded-checkout=true.

[25] MyJoyOnline. “Ghana govt, seven others partner on 5G shared network”. Accessed 12 November, 2024. https://citinewsroom.com/2024/05/ghana-govt-seven-others-partner-on-5g-shared-network/

[26] ITWeb Africa. "Kenya to Launch New Digital ID." Accessed October 9, 2024. https://itweb.africa/content/KA3Ww7dzZ25qrydZ.

[27] Adesina, Akinwumi. "Remarks by Dr. Akinwumi Adesina, President of the African Development Bank Group at COP 28, UAE." Accessed November 11, 2024. https://www.afdb.org/en/news-and-events/speeches/remarks-dr-akinwumi-adesina-president-african-development-bank-group-session-invest-africa-green-energy-access-digital-economy-and-infrastructure-finance-gap-cop-28-uae-1-december-2023-66463.

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)