New financing initiative to support Singapore firms entering Africa

Afrieximbank and ESG join hands to provide up to S$50m in funding

(left to right) Mr Geoffrey Yeo, Enterprise Singapore Assistant Managing Director; H.E. Dominic Goh, Singapore's ambassador to the Arab Republic of Egypt; and Mrs Oluranti Doherty, Afreximbank Managing Director, at the partnership agreement ceremony. Photo source: Enterprise Singapore.

(left to right) Mr Geoffrey Yeo, Enterprise Singapore Assistant Managing Director; H.E. Dominic Goh, Singapore's ambassador to the Arab Republic of Egypt; and Mrs Oluranti Doherty, Afreximbank Managing Director, at the partnership agreement ceremony. Photo source: Enterprise Singapore.

Enterprise Singapore, a government agency supporting the growth of domestic businesses, has partnered with the African Export-Import Bank (Afreximbank) to boost access to financing for Singapore companies seeking to do business in Africa. Under this new scheme, businesses in Singapore can apply for loans directly from Afreximbank, with Enterprise Singapore sharing up to 50% of the loan risk.

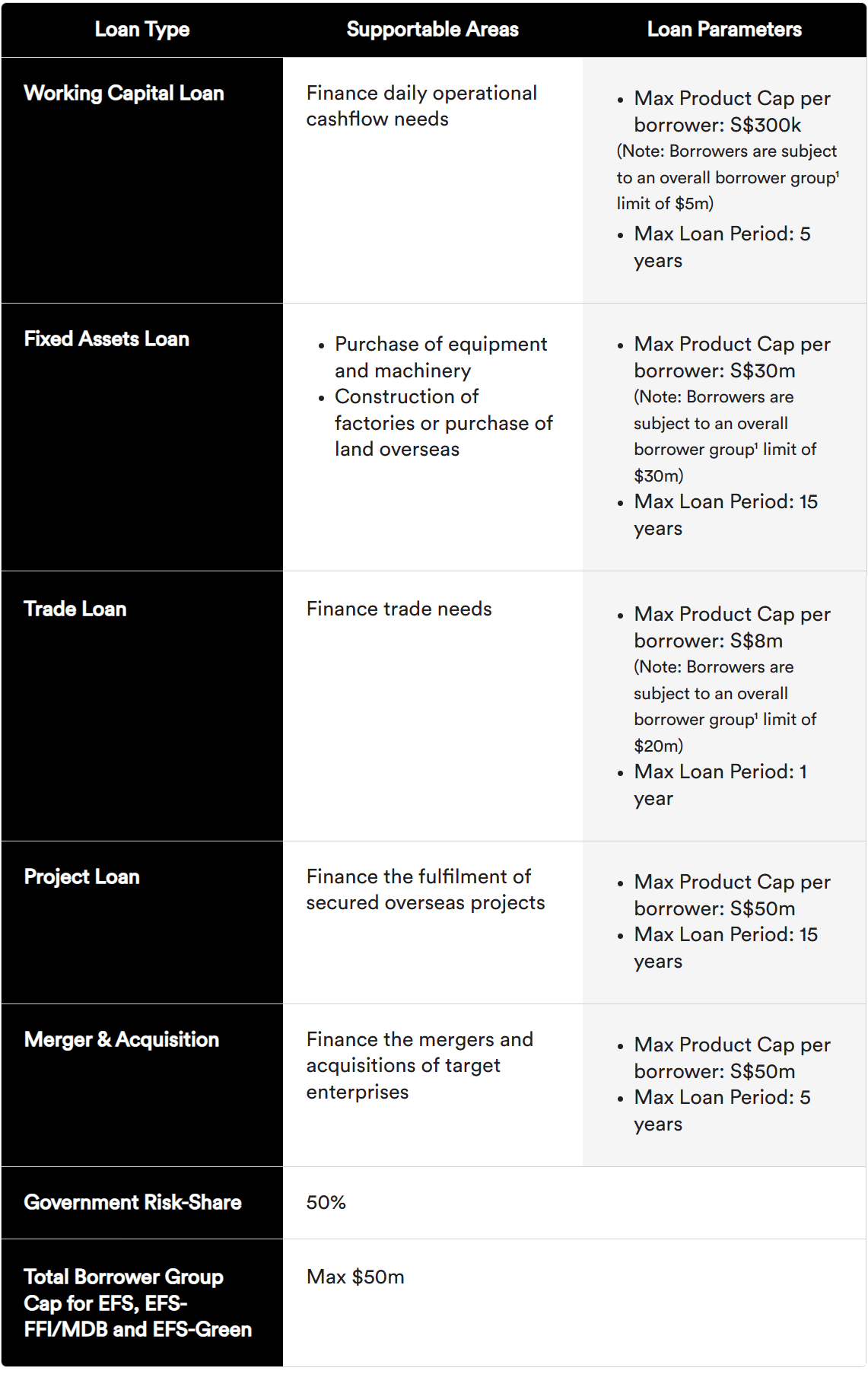

The initiative falls under the Enterprise Financing Scheme – Foreign-based Financial Institutions / Multilateral Development Banks (EFS-FFI/MDB), which aims to help Singapore enterprises access financing from FFIs and MDBs when expanding overseas. A range of funding options are available, including working capital, fixed assets, trade, project, and merger and acquisition financing, with amounts of up to S$50m (US$38m), depending on the specific product. Earlier this month, Enterprise Singapore signed a similar agreement with Credit Europe Bank, mirroring the Afreximbank partnership.

To qualify for the financing, businesses must be registered and physically present in Singapore, with at least 30% of equity directly or indirectly held by Singaporean citizens or permanent residents. For working capital loans, eligible companies must have an annual turnover of S$100m (US$76m) or less. For other types of loans, the turnover threshold increases to S$500m (US$382m). Additional criteria must also be met to qualify. If a borrower defaults, Afreximbank must first pursue its own standard recovery procedures for the outstanding loan before submitting a claim to Enterprise Singapore.

Eligibility Criteria for EFS-FFI/MDB

- be a business entity that is registered and physically present in Singapore,

- have at least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership,

- have group annual sales turnover of not more than S$100 million for Working Capital Loans,

- have group annual sales turnover of not more than S$500 million for all other product types.

1. Borrower; and

2. Corporate shareholders holding more than 50% at all levels up; and

3. Subsidiaries where the Applicant company holds more than 50% shareholdings and subsequent subsidiaries at all levels down; and

4. Subsidiaries where the Applicant’s Ultimate Parent Company holds more than 50% shareholdings and their subsidiaries at all levels

In 2023, bilateral trade in goods between Singapore and Africa reached S$16.3bn (US$12.4bn), with Singaporean investments in Africa totalling S$32.4bn (US$24.7bn) as of 2022. Currently, around 100 Singaporean companies operate across 40 African countries.

According to Enterprise Singapore, this partnership with Afreximbank will not only enable Singaporean firms to secure new financing sources for their ventures in Africa but will also help them navigate the complexities of the continent. The bank’s extensive networks and deep institutional knowledge are expected to assist companies in identifying potential local partners and gaining a better understanding of various African markets.

References

‘Enterprise Singapore partners Credit Europe Bank to help Singapore companies access financing overseas for expansion efforts’, Enterprise Singapore, 11 October 2024

‘New scheme lets local companies borrow from foreign lenders when expanding to Europe’, The Straits Times, 14 October 2024

‘Enterprise Singapore partners with African Export-Import Bank to catalyse financing for Singaporean companies expanding to Africa’, Enterprise Singapore, 15 October 2024

‘Enterprise Financing Scheme – Foreign-based Financial Institutions / Multilateral Development Bank’, Enterprise Singapore, Accessed 19 October 2024

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)