Start-up investments in Africa rebound

Q3 turns out to be the best quarter for African start-up funding since mid-2023

By Max Cuvellier Giacomelli

Start-ups in Africa raised over US$600m in the third quarter of the year, more than twice as much as in Q2, making it the best quarter of 2024 so far, on par with Q3 2023 numbers. The funding was significantly boosted by two major announcements from d.light and MNT-Halan (see below), which combined represented more than half of the funding raised. Overall, 44 start-ups raised US$1m or more during the period, a number higher than in Q2, yet lower than the 2023 quarterly average.

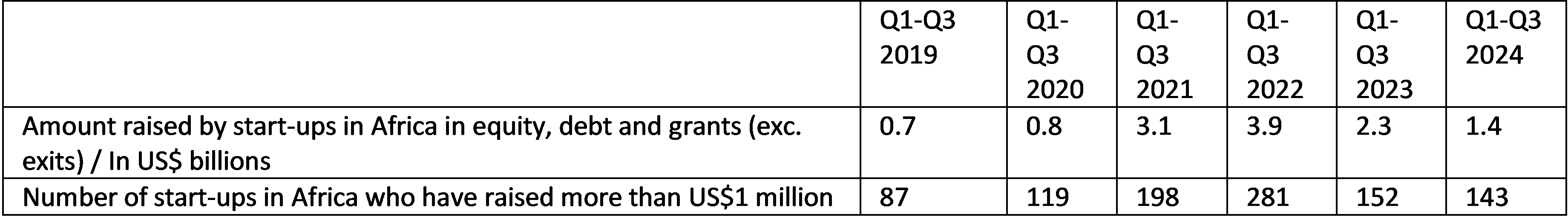

For the year so far, start-ups in Africa have now raised US$1.4bn, which compares favourably to pre-heatwave levels (2020, 2021) but is 38% lower than what it was at same time last year (US$2.3b). The number of start-ups raising US$1m or more has not significantly decreased, showing a slight 6% YoY decline. Looking at the past 12 months (Q4 2023-Q3 2024), start-ups have raised more funding than in the previous period 12-month period; it is the first time we are registering such a trend in two years, potentially indicating future growth for the ecosystem.

In Q3, 62% of the US$636m raised was in the form of equity, 35% in debt, and 2.5% in grant funding. The deal alone accounted for nearly 80% of all the debt raised in the quarter. In 2024 so far, two-thirds of the funding has been raised as equity and one-third as debt. These proportions are consistent with the same period in 2023, reflecting an increased offering of debt capital for start-ups in Africa and a greater propensity for ventures to raise debt, and communicate about it.

In terms of sectors, Fintech and Energy attracted the most funding in Q3, with Fintech raising US$363m (57%) and Energy US$199m (31%) i.e. 88% of the total funding. As of Oct 2024 to date, Fintech remains in the lead with US$600m (43%), followed again by Energy (US$300m, 21%). Logistics comes third, driven by significant deals in the first half of the year, including moove’s US$100m Series B[1] we covered in a previous article. Across sectors, more than half a billion dollars have been invested in climate-related ventures in Africa this year so far.

Geographically, Egypt and Kenya topped the charts in Q3, with Egypt raising US$272m (43%) and Kenya US$201m (32%). These two markets accounted for three-quarters of the funding raised in Africa in Q3. In 2024 so far, Kenya and Egypt have also raised the most funding: US$437m (31%) and US$373m (26.5%) respectively. Nigeria and South Africa have underperformed, with Nigeria raising US$218m (15.4%) and South Africa US$125m (8.8%). The rest of Africa accounted for 18.2% of the funding, with 23 markets recording at least one US$100k+ deal since January 1st, meaning 31 have registered no deal over US$100k in 2024 so far.

Unfortunately, investments continue to be directed disproportionally to male-led and male-founded ventures: less than 5% of the funding in 2024 has gone to start-ups with a female CEO, less than 1% to founding teams with only women, and only 9% to start-ups with at least a female founder. This represents a decline compared to previous years on all accounts.

The two largest deals of Q3 2024 were d.light and MNT-Halan. Energy start-up d.light has secured a US$176m securitisation facility from asset management company African Frontier Capital to expand its off-grid solar solutions in Kenya, Tanzania, and Uganda.[2] This funding comes after the US$7.4m in securitised financing from Chapel Hill Denham's Nigeria Infrastructure Debt Fund announced earlier this year, and the US$30m securitisation facility the company had secured last year from the Eastern and Southern African Trade and Development Bank Group (TDB Group).

In Egypt, fintech unicorn MNT-Halan has raised US$157.5m[3] in order to support its regional expansion. The funding round included US$40m from the IFC, as well as investments from Development Partners International, Lorax Capital Partners, and funds managed by Apis Partners LLP, Lunate, and GB Corp. This deal is MNT-Halan’s fifth ‘mega deal’ (US$100m+) since 2021 after raising US$120m in equity in September 2021, US$150m in debt in June 2022, US$400m in February 2023 (US$260m equity/US$140m debt), and US$130m in debt in November 2023.

The third deal in terms of size in Q3 was Nala’s US$40m Series A round led by Acrew Capital, with participation from DST Global Partners, Norrsken22, HOF Capital, and existing investors like Amplo and NYCA Partners[4]; high-profile angel investors - including Ryan King of Chime and Vlad Tenev of Robinhood - also chipped in. This funding, one of the largest Series A transactions ever recorded on the continent, will be used to build a new B2B payments platform and scale remittance services to Asia and Latin America.

Finally, while we can hope that investments will remain on an upward trend in Q4, it is now very unlikely that the 2024 final numbers will top the US$2.9bn raised in 2023. Indeed, this would mean that start-ups in Africa would have to raise more funding in Q4 than they have raised in the first three quarters of the year so far (US$1.5 bn).

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)