Risk-Averse Bidding Method for Overseas Solar Photovoltaic (PV) Plants in Singapore’s Wholesale Electricity Market

Synopsis

This innovation introduces a risk-averse energy trading method for solar PV bidding strategy in Singapore’s wholesale electricity market. Using stochastic optimisation, the method maximises expected profits while minimising financial risks from uncertain PV power generation and market price fluctuations. It also optimises energy storage system (ESS) planning, ensuring efficient energy storage solutions for solar PV plants, improving revenue stability and operational efficiency.

Opportunity

Singapore’s wholesale electricity market presents both opportunities and challenges for overseas solar PV plants. Fluctuations in PV power generation and market-clearing prices create financial risks, making solar power financial risk management essential for maximising profitability.

This risk-averse energy trading method enhances bidding accuracy, ensuring solar PV plants can operate profitably and sustainably. A key benefit is the optimisation of energy storage systems (ESS), helping determine the ideal ESS size for balancing power fluctuations and ensuring a stable, predictable energy supply.

Additionally, this strategy aligns with Singapore's push towards renewable energy integration and net-zero emissions by 2050, supporting sustainability goals while improving financial resilience in the energy sector.

Technology

This solar PV bidding strategy applies stochastic optimisation method to develop an optimal price-quantity bidding approach in Singapore’s wholesale electricity market. It minimises revenue volatility by accounting for uncertainties in PV power generation and market prices, improving both profitability and risk mitigation.

The methods also aids in energy storage system planning, optimising ESS deployment for solar PV plants to enhance operational efficiency. By ensuring stable revenue streams and reliable performance, this approach enhances the economic viability of solar PV plants, promotes broader adoption of renewable energy sources.

A core feature of this strategy is the ability to determine the optimal ESS size, enabling energy storage solutions that support stable and predictable electricity supply. This ensures that solar PV plants can maintain profitability despite unpredictable market conditions.

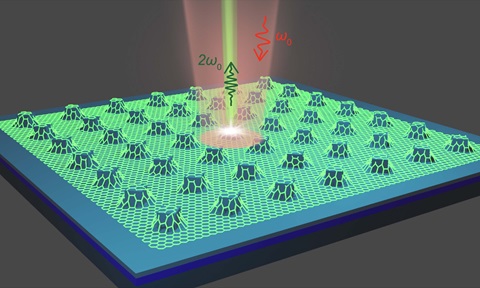

Figure 1: An overseas solar PV plant adopting the proposed bidding strategy in Singapore’s wholesale electricity market.

Applications & Advantages

Applications:

- Wholesale electricity market participation for overseas solar PV plants.

- Risk-averse energy trading for financial stability.

- Energy storage system planning for optimised ESS deployment.

- Solar power financial risk management for predictable revenue streams.

Advantages:

- Maximises expected profits while mitigating financial risks.

- Optimises energy storage solutions for solar PV plants, improving efficiency.

- Ensures stable financial performance despite market fluctuations.

- Supports sustainability goals by enhancing solar PV integration.

.tmb-listing.jpg?Culture=en&sfvrsn=3b74ec1c_1)