Executive confidence and myopic marketing management

The role of a Chief Executive Officer (CEO) transcends mere stewardship in today’s dynamic business environment. It demands a visionary leader capable of steering through difficulties and uncertainties. When falling short on earnings, CEOs often resort to short-term tactics such as implementing pay cuts or slashing marketing budgets to obtain immediate profits.

In an interdisciplinary study combining marketing and finance, Professor Angie Low (Nanyang Technological University) teamed up with Professors Roland T. Rust (University of Maryland) and Tuck Siong Chung (ESSEC Business School) to study how the psychological traits of executives can impact a firm’s marketing strategy. They analysed how executive overconfidence affects myopic marketing management, a tendency to cut current marketing spending to boost short-term earnings.

“Myopic marketing management trades off long-term performance for short-term gains, causing the firm's value to decline over time. However, overconfident CEOs believe they can generate high firm earnings in the future to offset the long-term losses caused by their short-sighted decisions,” remarked Professor Angie.

Power of Upper Echelon Leaders

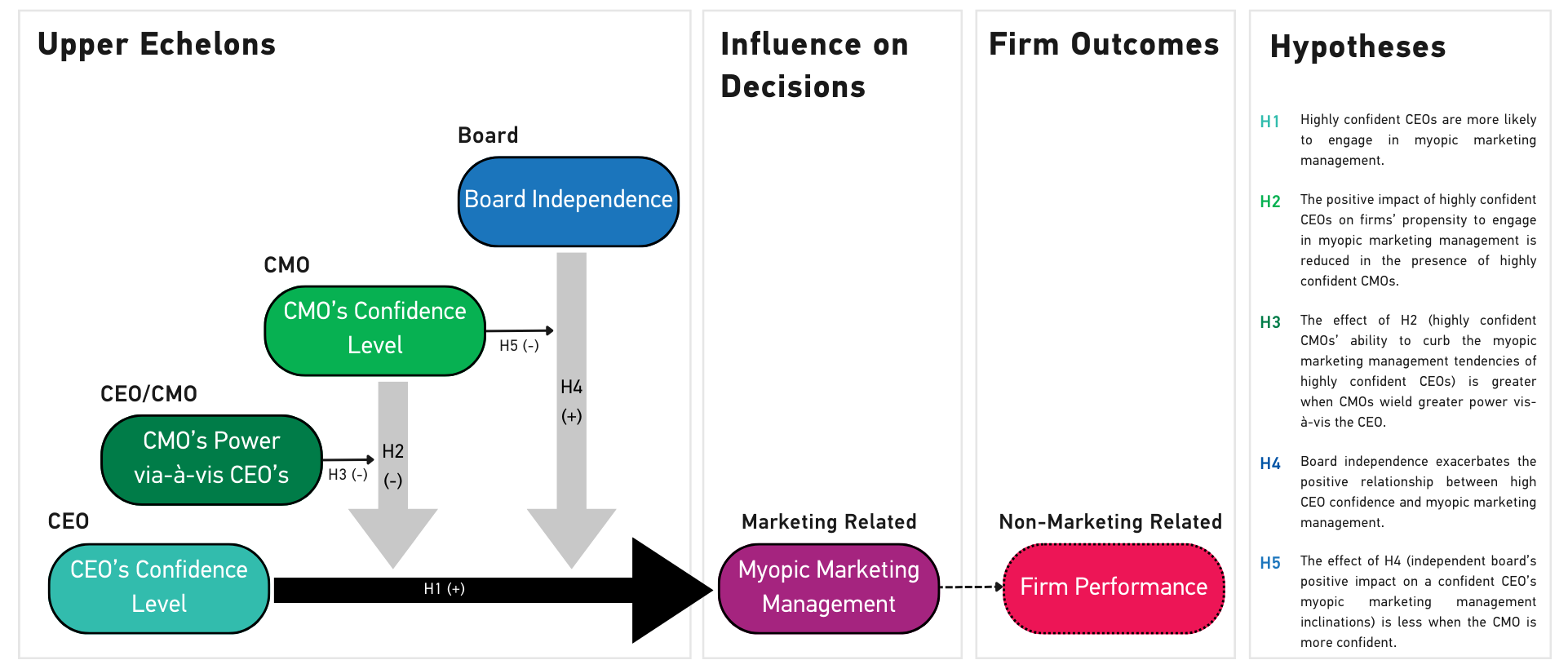

Figure 1. Conceptual model of how CMOs and Board of Directors interact with CEO overconfidence to influence myopic marketing management

Figure 1. Conceptual model of how CMOs and Board of Directors interact with CEO overconfidence to influence myopic marketing management

CEOs control the allocation of resources within the firm, playing a pivotal role in determining the marketing budget. The researchers propose five hypotheses to examine how the levels of confidence of the CEO and Chief Marketing Officer (CMO) and board independence influence myopic marketing management.

Firstly, highly confident CEOs are more likely to engage in myopic marketing management as they perceive it to offer higher benefits and lower costs. These highly confident CEOs believe in their abilities to generate superior future performance, assuming that any future firm value losses from cutting marketing expenses can be compensated for by achieving higher performance in other areas of the firm under their leadership. However, the CMO can influence the CEO’s marketing budget decision, especially if they display conviction in their judgment and ability to extract value improvement from their marketing recommendations. Therefore, the effect of confident CEOs on firms’ propensity to engage in myopic marketing management is reduced when CMOs are highly confident.

However, a powerful and confident CEO is likely to ignore the advice of their CMO, which could lead to frustration for the CMOs. Therefore, the ability of CMOs to curb the myopic marketing management tendencies of highly confident CEOs will depend on the relative power the CMO holds compared to the CEO. Furthermore, intense monitoring from an independent board of directors worsens the tendency for myopic marketing management under confident CEOs. Nevertheless, this relationship can be alleviated by CMO confidence. As board members evaluate CEOs based on short-term results, the latter will likely resort to myopic decisions. Confident CMOs can educate and convince their board of directors on the importance of sustained marketing investments. As a result, directors may emphasise marketing activities within the firm more and closely scrutinise any unexplained decreases in the marketing budget.

Marketing Myopia and Firm Dynamics

To test their hypotheses, the researchers sampled 675 distinct firms across various industries from 1996 to 2018. Executive confidence was inferred from the timing of executives exercising the company stock options that they previously received as part of their compensation. Confident CEOs and CMOs believe their leadership and marketing strategies can lead the firm to superior future performance. Hence, they delay exercising their stock options and continue holding onto valuable options, expecting further profit as the stock price increases.

“Myopic actions of firms are not directly observable. Hence, we need to infer from the accounting numbers reported by firms. A firm that reports an unexpectedly high performance and low marketing spending level is more likely to have engaged in myopic marketing management than other firms,” mentioned Prof Angie on how to detect marketing myopia in firms.

All five hypotheses were tested to be true. The researchers found that an interquartile increase in CEO confidence leads to a 0.29 percentage point increase in myopic marketing management. This translates into an estimated decline of $22 million in firm market value over the next few years. However, results also show that CMO confidence can attenuate the propensity of confident CEOs to manage marketing budgets myopically.

Preventing Marketing Myopia through Strategic Leadership

Firms must avoid falling prey to marketing myopia practices driven by overconfident CEOs. The research stresses the importance of empowering CMOs with confidence and organisational power to prevent CEOs’ myopic tendencies. Furthermore, the board of directors should be educated on the long-term value of marketing investments to avoid inadvertently promoting short-termism. Board members should also interact with other C-suite members, aside from the CEO, to better understand how each department can contribute to the firm's long-term value.

“Instead of cutting on the marketing resources, the CEO should take a long-term view regarding raising a firm’s earnings. This means that they should invest in good products and people, which should add to the firm value and increase the earnings in the long run,” advised Professor Angie.

By embracing strategic leadership, organisations can better safeguard themselves against the pitfalls of marketing myopia. Firms can take steps by cultivating an innovative culture and fostering collaboration between departments to raise profits collectively. Ultimately, by prioritising long-term value creation over short-term gains, firms can avoid the risks of myopic marketing strategies and position themselves for continuous success.

Note: This research paper was published by the Journal of the Academy of Marketing Science (Springer Link) in November 2022.

Dr. Angie Low is an Associate Professor of Finance at Nanyang Business School, Nanyang Technological University in Singapore and a fellow of the Asian Bureau of Finance and Economics Research. Angie's research interests include corporate governance, managerial compensation, corporate culture, and corporate social responsibility.

This research paper is a joint work with Professor Roland T. Rust (University of Maryland) and Professor Tuck Siong Chung (ESSEC Business School).