Improving Managerial Effectiveness in Employee Management: Emotional Intelligence or Tournament Incentives

In fostering a productive and high-achieving work environment, most organisations enforce managerial controls, which refers to mechanisms that restrict employees' effort discretion. As such, managers and leaders are tasked with performance evaluations and making decisions that influence employees to keep progress on track. However, controls may breed distrust and evoke negative emotions among trustworthy subordinates. As a result, it limits subordinates’ willingness and ability to resolve issues, reducing their efficiency.

Together with Professor Laura Wang (University of Illinois at Urbana-Champaign), Professor Yin Huaxiang (Nanyang Technological University) aims to understand why managers customise their decisions when it comes to controlling different subordinates. Their study highlighted two factors underlying managers’ tendency to tailor their control decisions: the emotional understanding ability of supervisors and the design of managerial compensation.

“Some managers tailor the way to individual employees such that some employees are allowed great discretion, while others are closely monitored through daily reporting. Those given more freedom usually have fewer check-ins with their managers and have the option to work remotely,” said Professor Huaxiang.

Subordinate-Type Information

Supervisors can assess the trustworthiness of their subordinates before implementing any form of control to prevent any negative emotions. They could obtain information showing whether a subordinate has worked hard by talking to former colleagues, clients, or supervisors and examining prior work documents. Hence, this subordinate-type information can reduce negative emotions from imposing control on trustworthy subordinates and maximise effort efficiency, thus enabling trustworthy employees to perform better.

The researchers hypothesised that the ability to understand emotions makes supervisors more sensitive to control-induced negative emotions. Hence, supervisors who understand emotions well will find subordinate-type information helpful, which they can use to avoid negative emotions from controlling trustworthy subordinates. However, supervisors who are poor at understanding emotions will not naturally find such information useful. Nonetheless, these supervisors will find it useful when there is a tournament incentive (disproportionally reward superior performance) rather than a piece-rate incentive (paid based on output).

Therefore, they predict that supervisors who understand emotions well (high-emotion understanding) are more likely to acquire and use costly subordinate-type information under piece-rate incentives. They also expect that compared to piece-rate incentives, supervisors who are poor at understanding emotions (low-emotion understanding) will be more motivated to gather subordinates’ work history under tournament incentives.

Trust vs Control: Contract Options

Professors Huaxiang and Laura conducted sessions with 80 participants who were assigned as supervisors or subordinates. Subordinates get to choose the effort level under two contract options offered by their supervisors: trust and control contracts. Trust contracts give subordinates maximum freedom, allowing them to choose no or high effort. Whereas control contracts demand at least some effort, where subordinates must put in minimum or high effort.

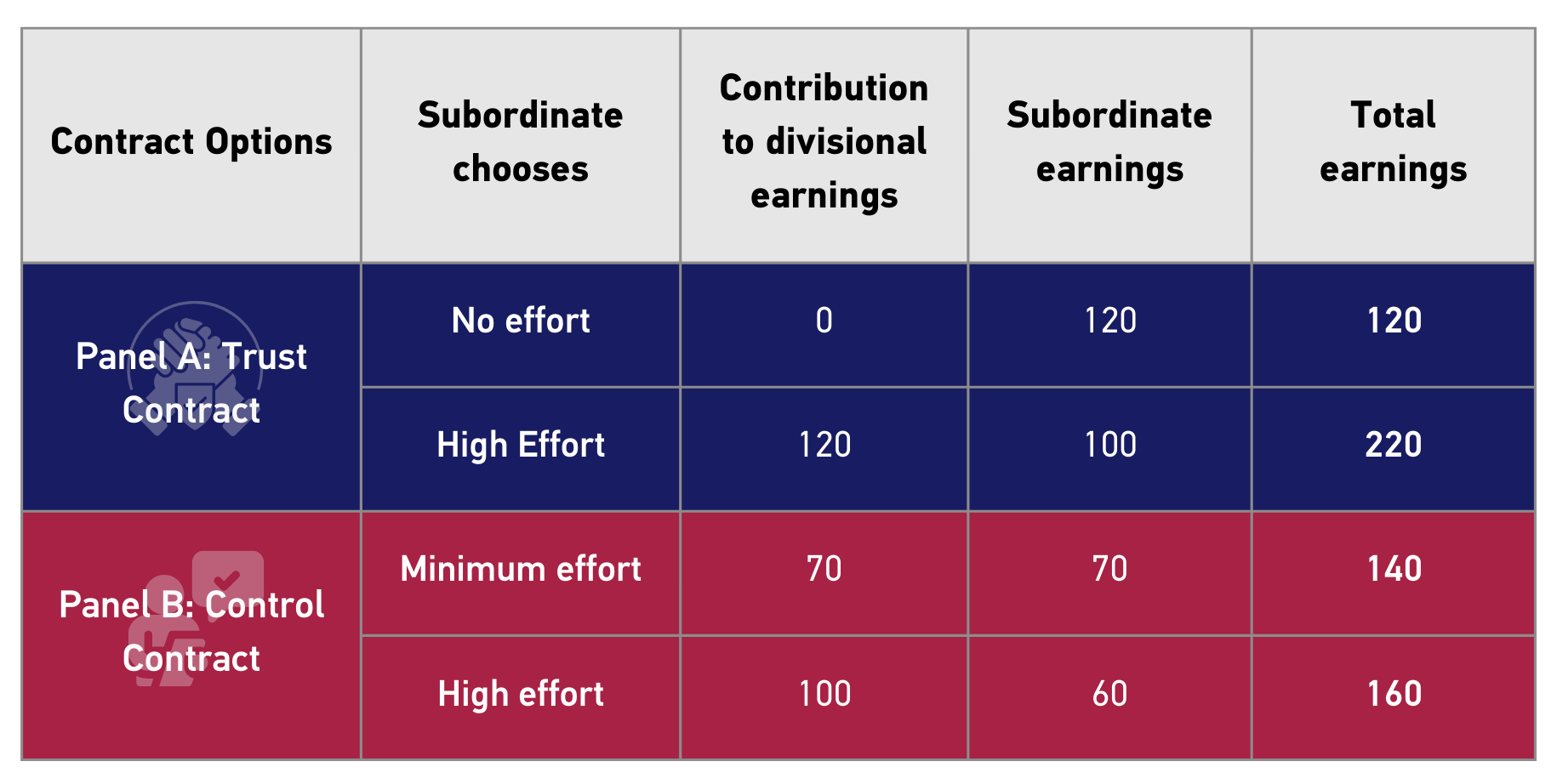

Figure 1. Payoff structure for the two contract options

Figure 1. Payoff structure for the two contract options

Based on the payoff structure (Figure 1), the divisional earnings under the control contract (70 tokens) are higher than the trust contract (0 tokens) if the subordinate chooses the minimum effort level possible. However, the subordinate earnings are maximised under the trust contract (120 tokens), which means they earn more despite putting in no effort. Notably, the sum of subordinate and divisional earnings when the subordinate exerts high effort is lower under the control contract (160 tokens) than the trust contract (220 tokens). Therefore, this shows that the control contract decreases the efficiency of subordinates' efforts by approximately 27%.

Professor Huaxiang remarked on the ideal contract options for subordinates and supervisors: “Our research shows that subordinates are always financially better off choosing the lowest possible effort level regardless of the contract option. Suppose we assume that subordinates always want to earn the most money. In that case, supervisors are better off choosing the control contract as the minimum effort level is higher under the control contract than the trust contract.”

Emotional Understanding Ability and Incentives

The study measures participants' emotional intelligence through a psychometric scale, Situational Tests of Emotional Understanding (STEU). Based on the STEU level, they classify participants in the supervisor role into high emotional-understanding supervisors and low emotional-understanding supervisors. They further implement two managerial compensations for supervisors. Half of the supervisors earn a piece-rate per dollar of their divisional earnings (piece-rate incentive), and the other half enter into a tournament based on their divisional earnings. Winning supervisors earn much more than the losing supervisors (tournament incentives). Supervisors decide how much to bid for their subordinates’ work history before deciding whether to control this subordinate (i.e., choosing the trust or the control contract for the subordinate).

They found that, when supervisors receive the piece-rate incentive, high emotion-understanding supervisors bid more than their low emotional-understanding counterparts for their subordinates’ work history. This suggests that high emotion-understanding supervisors recognise the importance of understanding what type of persons their subordinates are before deciding whether to control them.

Meanwhile, low emotion-understanding supervisors bid more for their subordinates’ work history when they receive the tournament incentive than the piece-rate incentive. This could be because low emotion-understanding supervisors are more driven by competitive pressures and the desire to use any available advantage (e.g. acquiring subordinate-type information) to improve their organisational standing.

Furthermore, the researchers recommend that companies struggling with reduced efficiency due to strict controls should give supervisors more decision-making power. This can enhance subordinates’ performance, especially when hiring emotionally intelligent supervisors or using tournament incentives. Notably, hiring high emotion-understanding supervisors may be more effective than tournament incentives in acquiring subordinate-type information if their ability can be helpful in other managerial tasks.

Professor Huaxiang mentioned, “Generally, low emotion-understanding managers do not have much interest or make time to get to know their employees better. Hence, tournament incentives are more effective than piece-rate incentives in motivating low emotion-understanding managers to gather information about their subordinates”.

Creating a Cohesive and Productive Culture

Every team member brings unique skills, personalities, motivations, and challenges to the workplace. Therefore, supervisors need to manage subordinates differently, as it enhances the performance and motivation of the employees. Moreover, managers equipped with high emotional intelligence can boost communication and morale, and drive informed decision-making. Incorporating emotional understanding with effective incentives fosters a cohesive and high-performing organisational culture.

Note: This research paper was published by the Accounting, Organizations and Society (ScienceDirect) in May 2023.

Huaxiang Yin is an Associate Professor of Accounting at Nanyang Business School, Nanyang Technological University. His work focuses on experimental research, combining insights from economics, behavioural economics, and psychology. He investigates the use of accounting information for managerial decision-making, in particular, how middle-level managers use accounting information and how accounting information influences their decisions.